Electricity system security of supply in Scotland

DOI: http://dx.doi.org/10.7488/era/3737

Executive Summary

Overview

Scotland’s electricity system is undergoing a transformation with rapid increases in installed wind and solar electricity generating capacity. This is coupled with the phase out of nuclear and unabated gas power stations.

This will impact on Scotland’s electricity system security of supply, which has historically relied on large, centralised fossil fuel power plants. These can ramp power production to meet demand, in addition to grid network connection to the rest of Great Britain. Here ‘security of supply’ refers to the ability of the system to reliably and continuously provide a sufficient amount of electricity to meet the demands of consumers.

In this report, we explore issues around security of supply in Scotland’s electricity system in the transition to net zero by 2045. We examine international examples of national and regional electricity systems transitioning to net zero and review the potential impact of electricity market reform. We use scenario modelling to quantify security of supply and import/export metrics for the expected technology pathway in Scotland.

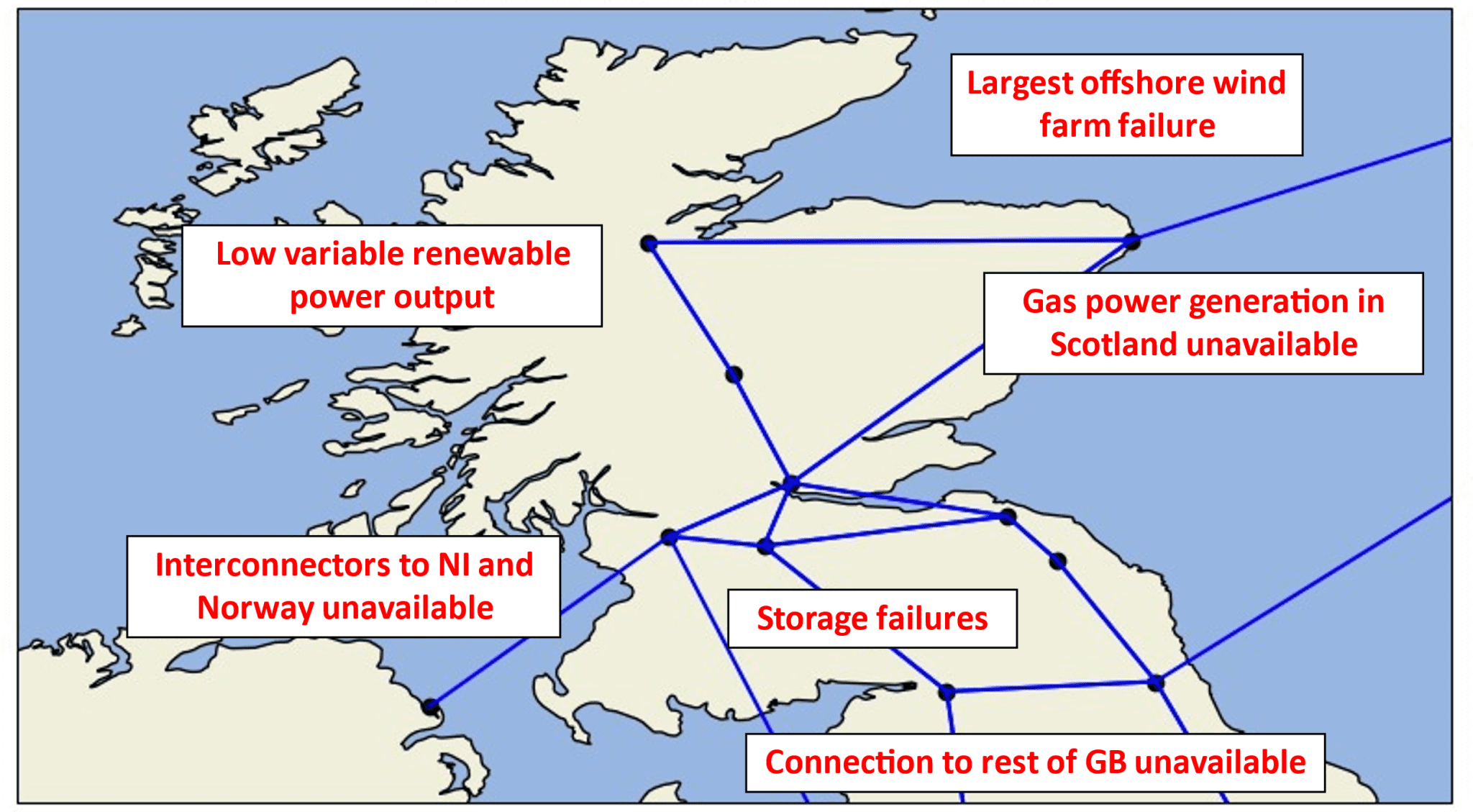

The future security of supply of Scotland is subjected to stress tests, including disconnection of offshore wind farms; low variable renewable power output; unavailable gas power generation in Scotland; unavailable interconnectors; battery storage failures; and an unavailable connection to the rest of GB. The report also looks at the security of supply of a self-sufficient Scotland, with no interconnection to Europe or the rest of Great Britain, in addition to a low capacity and high demand scenario to further test Scotland’s future electricity system.

Key findings

- Examples of national and regional electricity systems operating with high proportions, in excess of 100%, of renewable electricity are typically dominated by hydropower and pumped hydro storage reservoirs. These are dispatchable and offer high levels of security of supply.

- Scotland and Denmark are leading examples of national electricity systems integrating large shares of variable renewable energy sources, but rely on imports with neighbouring countries.

- Potential changes to electricity market arrangements such as splitting the wholesale market, locational pricing and an enhanced capacity market could have impacts on future investment in renewables and flexibility technologies in Scotland.

- Under the System Transformation scenario there will be a reduction in traditional firm generation capacities in Scotland. This includes no nuclear and reduced gas power plant generation when changing to carbon capture and storage technology. However, these losses will be offset by vast increases in wind and solar installed capacity, as well as increasing low-carbon firm generation capacity in the form of biomass, hydrogen and abated gas power plants.

- Security of supply metrics for Scotland in the System Transformation scenario for the years up to 2045 were found to be within the current GB reliability standards and comparable to current levels. Security of supply in Scotland improves in the transition towards net zero by 2045 due to large increases in generation capacity and storage.

- Peak demand in Scotland is expected to rise from around 5000 MW in 2021 to around 9000 MW by 2045 but is exceeded by generation, even when considering expected availability in real time. While the generation capacity in Scotland may seem excessive in the context of security of supply in this scenario, it is utilised to decarbonise and provide security of supply to GB as a whole.

- Scotland will continue to be a net electricity exporter to the rest of GB and net exports will increase from current levels. There will be an increase in the level of import from the rest of GB due to increased demand, coupled with increased reliance on variable wind power generation, which leads to more imports during low wind periods.

- Testing of the future Scottish electricity system, assuming low installed capacity for thermal power plants, low B6 boundary expansion and high future peak demand, shows lower security of supply in 2030 than the GB reliability standard.

- In 2025 and 2030 disconnection with the rest of GB has the highest impact of all of the stress tests conducted, followed by unavailable interconnectors and gas supply issues. This implies that there is a high reliance on imports from and exports to the rest of GB in maintaining the capacity adequacy in Scotland. However, its significance is negligible from 2035, when there is a large increase in offshore wind capacity and additional capacity of battery storage, pumped hydro, hydrogen power plant and biomass.

- A self-sufficient Scotland with no connection to the rest of GB and no interconnector capacity would violate the GB reliability standard in the years 2025 and 2030, mainly due to periods of low wind and renewables output without sufficient dispatchable supply capacity. However, by 2035 the security of supply metrics are within historical values and improve further in the following years. We find 250 MW and 1000 MW of additional equivalent firm capacity would be needed in 2025 and 2030 to meet minimum reliability standards and historically typical standards respectively. This would be the equivalent of an additional 1,553 MW to 6,211 MW installed capacity of offshore wind.

Glossary

|

Black Start |

The procedure used to restore power in the event of a total or partial shutdown of the national electricity transmission system. |

|

CT (Community Transformation Scenario) |

A scenario from the FES that achieves the 2050 decarbonisation target in a decentralised energy landscape. |

|

De-rated Generation Capacity |

The amount of power that can be produced by a generation source after a reduction factor is applied to the installed capacity to reflect what is expected to be available in real time. |

|

Equivalent Firm Capacity (EFC) |

An assessment of the entire wind and solar PV fleet’s contribution to capacity adequacy, representing how much of 100% available conventional plant could theoretically replace the entire wind fleet and leave security of supply unchanged. |

|

FES (Future Energy Scenarios) |

A set of energy system scenarios for the UK, covering the period from now to 2050, developed in conjunction with the energy industry, to frame discussions and perform stress tests. They form the starting point for all transmission network and investment planning and are used to identify future operability challenges and potential solutions. |

|

Load Factor (or Capacity Factor) |

The amount of electricity generated by a plant or technology type across the year, expressed as a percentage of maximum possible generation. Load factors are calculated by dividing the total electricity output across the year by the maximum possible generation for each plant or technology type. |

|

Loss of Load Expectation (LOLE) |

The expected number of hours in a year when demand exceeds available generation before any emergency actions are taken. LOLE is calculated after all system warnings and System Operator (SO) balancing contracts have been exhausted. It is important to note that a certain level of loss of load does not necessarily result in blackouts, as actions can be taken without significant impacts on consumers. The UK Government’s Reliability Standard requires an LOLE of no more than 3 hours per year. |

|

Peak Demand |

The highest level of electricity demand in a fiscal year, which typically occurs around 5:30pm on a weekday between November and February. |

|

Security of Supply (SoS) |

A general term used to describe the maintenance of required energy flows to consumers at all times. Specific criteria are used across different fuels, and SoS can cover network resilience as well as adequacy more generally. |

|

ST (System Transformation Scenario) |

A scenario from the FES where the target of reaching net zero is achieved by a moderate level of societal change and a low-moderate level of decarbonisation. |

|

Variable Generation |

Types of generation that can only produce electricity when their primary energy source is available and driven by weather. For example, wind turbines can only generate when the wind is blowing. |

Introduction

Background and aims

Scotland is committed to net zero greenhouse gas emissions by 2045 through the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019 [1]. This means net zero emissions across all sectors of the economy, including from the energy system. In the power sector, traditional thermal generation, such as nuclear power and gas power plants are being retired and there are ambitions for realising 8-11 GW offshore wind capacity by 2030 [2]. Under some net zero scenarios this could increase to more than 35 GW by 2045 in Scotland [3]. Additionally, under National Grid’s ‘Leading the Way’ scenario in Scotland solar PV rises from 0.5 GW in 2021 to 6 GW in 2045, and onshore wind rises from 9 GW in 2021 to 27 GW in 2045.

This raises the importance of security of supply in Scotland with an electrical system that has high levels of weather-dependent wind and solar energy. The transition to net zero brings new challenges to Scotland’s electricity system security of supply:

- Torness nuclear power plant is due to close before the end of this decade resulting in the loss of the baseload output from this electricity generator.

- Peterhead gas power station may close as an unabated gas power plant and be replaced by a gas power plant fitted with carbon capture and storage technology. It is uncertain whether new carbon capture power plants can be operated flexibly or will be required to produce electricity round-the-clock.

- Increased reliance on intermittent renewable energy sources causing greater disparity between generation and demand on hourly, daily, monthly, and seasonal timescales.

- Increased need for electrical network expansion and reinforcement to transport renewable electricity to high demand areas.

The emissions reduction pathway shown in the 2020 climate change plan update [4] accordingly sets out a vision for net zero emissions from the electricity sector by 2029.

- Investigate international examples of national electricity systems operating/moving towards reliance on renewables.

- Review expected/planned policy or regulatory developments, such as locational pricing, which could impact the future system.

- Assess technology developments needed in Scotland to ensure a secure and reliable supply of low and zero carbon electricity to 2045.

- Assess the likely impacts on transfers of electricity from/to Scotland and the rest of GB, in a Scottish electricity system powered almost entirely by intermittent renewables.

- Calculate additional volume and type of generation that would be required for Scotland to have an entirely self-sufficient system (also including black start capability).

Security of supply

Security of supply in electrical power systems is the ability to match supply and demand with high probability, both under normal and unexpected conditions. This includes the coldest periods when peak demand often occurs; during outages of large power plants or interconnectors; and dark, windless periods when there is low renewable generation.

Challenges for future security of supply

Meeting the peaks in electrical demand is key in determining security of supply. If this demand can be met with high probability, then it is likely that all other periods with lower demand can also met. However, in systems where a high proportion of generation is from variable renewable sources then there will also be periods when high generation coincides with lower demand, which can lead to excess generation. Periods of excess generation is not the focus of this report but it is recognised that this can also provide challenges in an electrical system, such as costs of constraints, and that these periods require reliance on flexibility technologies such as storage and interconnection.

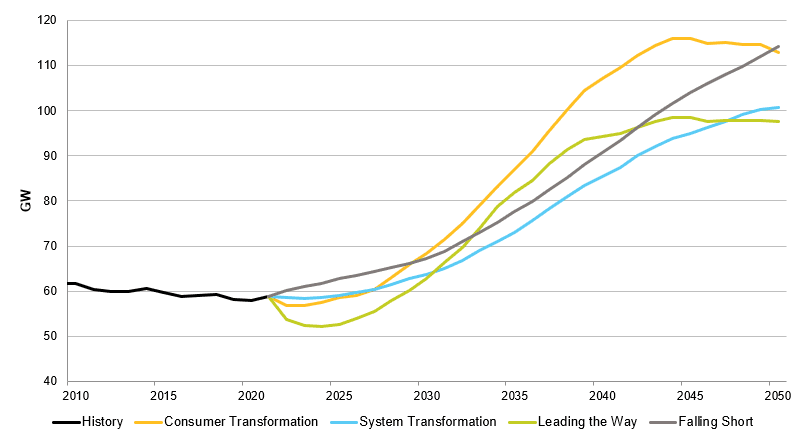

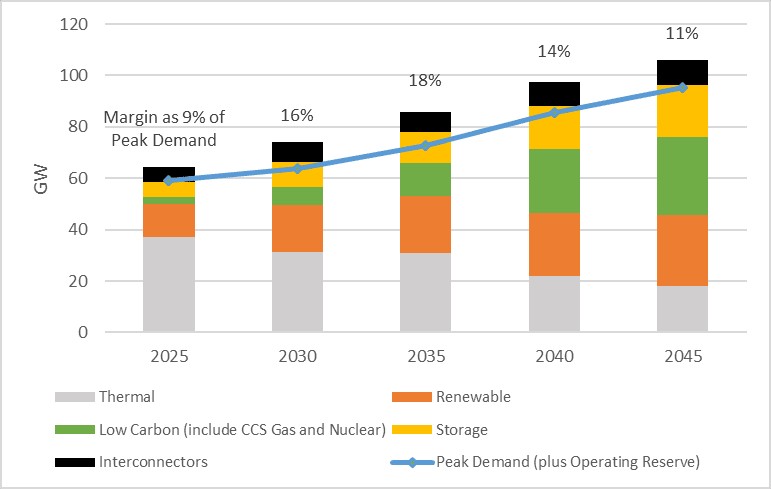

Peak electrical demand is expected to grow in the UK[1] from around 60 GW seen for the past decade to 100 – 115 GW in 2050 [Figure 1]. These rises are strongly driven by electrification of heat and transport.

Figure 1 Peak demand during average cold spell increasing according to Future Energy Scenarios

In the future, it is expected that there will be increasing flows of power between Scotland and the rest of GB. The extensive wind resources, both onshore and offshore in Scotland, offer high and consistent wind speeds which makes Scotland an attractive place to build wind farms. However, electricity demand is far greater in England than in Scotland. In 2021 peak electricity demand was around 11 times higher across the rest of GB (55 GW) compared with Scotland (5 GW). National Grid’s ‘System Transformation’ scenario from the Future Energy Scenarios (FES) predicts broadly similar levels of installed wind capacity by 2050 (onshore and offshore) in the rest of GB (around 71 GW) and in Scotland (around 59 GW) [3]. This will lead to more reliance on the electrical network for transmitting the necessary electricity to ensure security of supply on both sides of the Scotland/England power system boundary.

Security of supply in the UK in National Grid’s Winter Outlook

Peak electricity demand often occurs during cold weather, and National Grid publish a winter outlook on security of supply every year. The report provides analyses of forecasted weather, expected power plant issues, and estimated import and export capabilities of interconnectors to Europe. The impacts on probability of the UK electricity system to be able to reliably meet electricity demand are also assessed. For more information on the 2022/23 winter outlook see Appendix 12.1.

Under normal conditions the electrical power system at present meets security of supply thresholds, but wider geopolitical issues have shown that it is vital to consider ‘unlikely’ stress events to the system. The winter outlook gives the current view on security of supply in the short-term but given that it takes years to build electrical power infrastructure it is important to consider how security of supply will evolve in the future.

The transition to net zero is informed by creating scenarios for the expansion of capacities of generation, demand, flexible technologies such as batteries and pumped hydro, and electrical networks.

Issues around operability

Black starts are the process for recovering the entire power grid following a highly unlikely[2] complete shutdown. However, not all generators have black-start capability. Conventionally, it is provided by a limited number of large coal, gas, and diesel generators. Following a highly unlikely event of a total or partial shutdown of the national electricity transmission network, black start plants can start independently, by using on-site equipment and fuel. They are independent of wider system input or specific weather conditions and can set up a skeleton network. Gradually different components can be reconnected to re-establish normal operation.

Wind turbines were previously viewed as unsuitable for black start due to dependence on external electricity before they can begin generating power. However, some of the latest designs are capable of self-starting. For example, in 2020, the 69 MW Dersalloch wind farm provided a black-start function through alternative control of power electronics using a virtual synchronous machine approach to restart part of the Scotland grid [5]. Battery storage, which has seen fast growth in UK, can also contribute to a black start. National Grid has committed to consider the provision of black start from non‑traditional generation technologies to facilitate the restoration of the future GB power system [6].

Aspects of security of supply also include the sufficient provision of ancillary services to stabilise power system operation. Ancillary services are not within the scope of our work, but a short commentary can be found in Appendix 12.2.

Scotland’s electricity system

Scotland’s electricity system operates as a part of the wider GB power system meaning electricity supply and demand must be always equal across the whole of GB. Generators anywhere in the GB power system can sell electricity to any demand, regardless of distances, through bilateral agreements and power exchange markets. It is then the responsibility of the energy system operator, National Grid ESO, to redispatch generation and demand to ensure that the physical electrical network can cope with the trades.

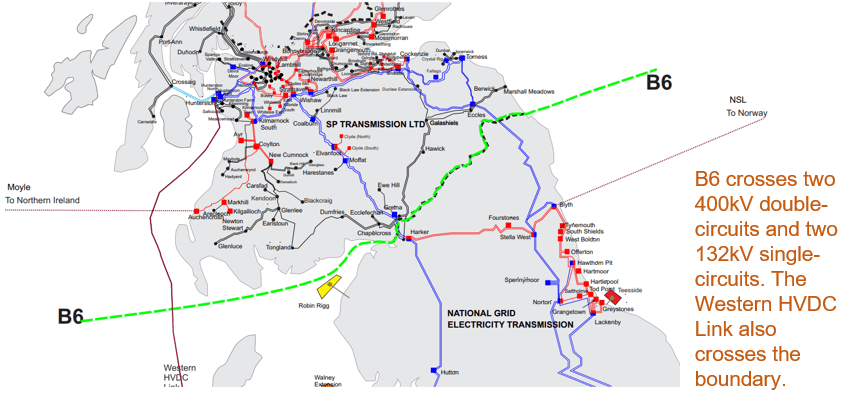

In the north of Scotland, the transmission and distribution network are operated and owned by Scottish & Southern Electricity Networks (SSEN). In the south of Scotland the transmission and distribution network are operated and owned by Scottish Power Transmission (SPT) and Scottish Power Energy Networks (SPEN) respectively. These transmission networks interface with the transmission network operated by National Grid Electricity Transmission which covers England and Wales, see Figure 2.

The boundary between Scotland and the rest of GB will be subject to future increased power transfer requirements due to additional onshore and offshore wind generation locating in Scotland. When there is low generation output in Scotland there may be power flowing from the rest of GB to Scotland to meet demand. However, these flows will be low compared to the flow from Scotland to the south so there is unlikely to be further requirements for network extension to support this on top of those for flows from Scotland. According to National Grids ETYS21 [7] there is currently a total of 6,100 MW transfer capability between Scotland and the rest of GB[3].

Figure 2 Network infrastructure in 2022 across the B6 boundary [7]

Table 1 outlines the installed firm generation and the corresponding de-rated capacity in Scotland for the year 2021. Firm generation is defined here as generation types which can generate when required, and independently of external factors such as weather conditions. We also account for “de-rated” capacities where aspects such as outage rates are incorporated. Table 1 shows the de-rated firm generation and interconnector capacity in Scotland in 2021 was 8,489 MW while peak demand was 4,890 MW. Peak demand as a percentage of total firm de-rated capacity in Scotland was therefore 58%, meaning that there was secure installed firm capacity which is likely to meet demand in 2021. Therefore, the current generation mix in Scotland’s electricity system provides sufficient security of supply.

In the next sections, we will investigate scenarios for what the future electricity system in Scotland will look like and undertake more detailed analysis into how security of supply may evolve.

Table 1 Total and de-rated firm generation and interconnector capacity (MW) in Scotland in 2021 (see Appendix 12.13 for de-rating factors)

|

Total (MW) |

De-rated (MW) | |

|

1,750[4] |

1,302 | |

|

Hydro |

1,779 |

1,621 |

|

Gas |

1,238 |

1,130 |

|

Pumped hydro |

740 |

704 |

|

Interconnector |

160[5] |

80[6] |

|

England and Wales grid connection |

6,100 |

3,0506 |

|

Biomass |

208 |

183 |

|

Sum of generation and interconnector firm capacity |

11,975 |

8,070 |

|

Peak demand in Scotland |

4,890 | |

|

Peak demand as percentage of sum of firm generation and interconnector capacity in Scotland |

41% |

61% |

|

System margin (Total rated or de-rated minus peak demand) |

7,085 |

3,180 |

100% renewable electricity systems

Renewable electricity generation technologies can be split into two categories related to the challenges of accommodating them into power grid [8] [9]:

- Variable Renewable Energy (VRE): dependent on short-term weather conditions, and typically use invertors to interface to the grid, for example, wind and solar; and

- Non-VRE technologies: dispatchable generation using synchronous generators including hydro with reservoir, biomass, geothermal, and concentrating solar power with thermal storage.

For VRE, additional flexible technologies such as dispatchable generation and energy storage are required to compensate intermittency. For non-VRE generation, the timing and volume of production can be adjusted to follow demands and market developments.

In this work, a 100% renewable electricity system is defined as: a system that operates exclusively on renewable energy sources, such as wind, solar, hydro, geothermal, and bioenergy. It does not rely on non-renewable sources such as fossil fuels, nuclear energy, or other non-sustainable sources of energy. The renewable sources can be instantaneous outputs from renewable generation, discharged energy stored previously from renewable electricity, or even imported renewable electricity from connections with neighbouring systems. 100% renewable electricity system is technically achievable, and this section explores countries and regions where they exist. However, there are exponentially increasing costs to reach 100% [10] [11] [12].

Several national electricity systems in the world already operate with, or close to, 100% renewable electricity. Details can be found in Appendix 12.3. Further detail on national electricity systems with high shares of VRE generation (operating with less than 100% renewable energy) can be found in Appendix 12.4. Details of regional electricity systems operating with near to 100% renewable electricity can be found in Appendix 12.5.

Table 2 summarises key features in countries and regions with high share of renewables in power production. For countries already operating with (or very close to) 100% renewable electricity supply, the share of VRE is actually very low. For countries and regions with a high share of VRE generation, despite future 100% renewable electricity targets, fossil fuel dispatchable generation is still playing a major role to provide flexibility – either from gas and coal plants within its system or imported through connections.

Table 2 Comparison between counties and regions with high share of renewable power production (2020 data, see Appendices 12.3 – 12.5)

|

Country or region |

Overall share of renewables in power production |

Share of VRE |

Main source of flexibility |

Main renewable type |

Total renewable generation exceeding annual electrical demand? |

|

Iceland |

100% |

None |

Hydropower plants with dams and reservoirs; |

Hydro (76%) |

No |

|

Paraguay |

99% |

<1% |

Hydropower plants with dams and reservoirs |

Hydro (99%) |

No |

|

Norway |

98% |

6.4% |

Hydropower plants with dams and reservoirs |

Hydro (92%) |

Over 109% in 2022 |

|

Denmark |

84% |

60% |

Coal, gas power plants and dispatchable CHP |

Wind |

No |

|

Ireland |

43% |

37.2% |

Gas power plant (51%) |

Wind |

No |

|

UK |

43% |

28% |

Gas power plant (36%) |

Wind |

No |

|

Germany |

44% |

37.5% |

Gas (12%) and coal (24%) power plant |

Wind solar PV (10%) |

No |

|

Orkney |

100% |

100% |

Interconnection with UK mainland |

Wind |

Over 130% |

|

Mecklenburg-Vorpommern in Germany |

87% |

87% |

Coal power plant and connection to neighbouring states |

Wind |

Over 170% |

|

Scotland |

57.0% |

82% |

Gas power plants, hydro and import/ export from the rest of UK (exports 20.3 TWh, imports 1.5 TWh in 2022) |

Wind |

No – 85% in 2021 (98% in 2020) Mild weather affecting generation |

Renewable electricity in Scotland

In 2020, the generation of renewable electricity in Scotland was equivalent to 97.4% of its gross electricity consumption. However, as shown in Figure 3, fossil fuel generation accounted for 15.6% and nuclear for 16.9% of the total electricity consumption in Scotland.

Figure 3 Proportion of electricity consumption by fuel in Scotland 2022 [13]

Scotland also exchanges large quantities of electricity with England, Wales, and Northern Ireland, mainly exporting rather than importing. To achieve a reliable and resilient 100% renewable electricity system in Scotland will require a set of low-carbon solutions to fill the increasing gap of flexibility requirement when more renewables are set to connect but fossil fuel and nuclear generation are phased out.

Changes to electricity markets

The transition to a net zero energy system requires large-scale building of new power infrastructure. For example, upgraded and new transmission lines to meet increasing power demands; large onshore and offshore wind farms in remote areas; dispatchable power plants running on Hydrogen or fitted with carbon capture and storage (CCS) technology; and flexible technologies which can respond at different timescales to increasingly variability such as pumped hydro storage.

The need for reform is exemplified by curtailment costs in the UK doubling in just one year, from £145 million in 2019 to £282 million 2020 [14]. Well-designed electricity markets should efficiently incentivise capacity investment as well as dispatch of generation and network assets to facilitate the net zero transition.

Significant reforms of electricity markets in the UK are required to enable the transition to a net zero energy system at low cost while ensuring security of supply. Potential changes to electricity market arrangements were outlined in a consultation document on potential reforms published by BEIS in July 2022, ‘Review of electricity market arrangements’, referred to as REMA [15]. The aim of REMA is to establish the electricity market reform necessary for a fully decarbonised electricity system by 2035, which supports the transition to an economy-wide net zero energy system by 2050. The reforms are intended to form the final critical step towards supporting the net zero transition.

The main approaches outlined in REMA are reforming to a net zero wholesale market; markets suited to the roll out of mass low-carbon power; incentivising investment in flexibility technologies such as by introducing locational pricing; ensuring capacity adequacy; and reforming ancillary services which enable operability. There is significant debate around the advantages and disadvantages of these potential reform measures. These approaches and potential impacts on the Scottish electricity system are outlined below. More background information on these reforms can be found in Appendix 12.6.

Technology development in Scotland to 2045

Scotland pathway using FES22

We use National Grid’s FES [3] as the baseline for technology development in Scotland to 2045. Based on FES pathways, we extracted and scrutinised data specifically for Scotland. FES is external to the Scottish Government and takes a UK-wide approach and may not necessarily be consistent with Scotland’s annual emission targets. However, it has a high level of detail including a regional breakdown which means that Scotland specific data can be extracted. We modelled metrics that provide a measure of security of supply and investigate this with an extended set of stress tests applied.

Four scenarios are presented in FES with three pathways meeting net zero targets and one pathway that falls short (see Appendix 12.7). This report uses the System Transformation scenario as the baseline for installed firm generation capacity, installed VRE generation capacity, peak demand, installed storage capacity, network connection to England and Wales and interconnectors to Northern Ireland and Norway. The System Transmission scenario was chosen because it represents a middle-ground in terms of the expansion of technologies compared to the Leading the Way and Falling Short scenarios. It is recognised that the System Transformation scenario is not aligned with Scottish Government policy with a high usage of hydrogen for heating. The following modifications were made to the System Transformation scenario:

- Offshore wind installed capacity by 2030 was changed from 7,000MW to 9,500 MW in line with Scottish Government targets.

- Interconnector capacity was extended from solely the 500 MW Moyle interconnector to this plus 700 MW interconnection to Norway (1200 MW overall) from 2035 which is in line with the Consumer Transformation scenario.

We used the PyPSA-GB model of the electrical power system for modelling FES data and for calculating power flow, see [16] and Appendix 12.9 for more details. Data is included for the years 2021, 2030, 2035, 2040, and 2045.

Installed firm generation

Figure 4 shows the installed firm generation capacity in Scotland for the System Transformation scenario.

- The last remaining nuclear power station in Scotland, Torness, closes in 2028.

- The existing Peterhead Combined Cycle Gas Turbine (CCGT) power plant is assumed to close in 2026 and open as Peterhead 2 with reduced capacity (1,200 MW CCGT to 910 MW CCGT + CCS) in 2027. The CCS Gas generation capacity is then doubled between 2040 and 2045 to 1,800 MW.

- Hydrogen powered generation capacity is also added with 690 MW by 2040 and 1,924 MW by 2045.

- Hydro power plants see moderate increases out to 2045.

- Significant increases in biomass generation capacity to around 1,900 MW in 2045.

Figure 4 Installed firm generation capacity (GW) in Scotland under the System Transformation scenario

Installed variable renewable generation

Figure 5 Installed VRE generation capacity (GW) in Scotland under the System Transformation scenario. Offshore wind in 2030 has been changed to 9.5 GW to reflect Scottish Government ambitions of 8-11 GW

- Solar Photovoltaics capacity consistently grows from 462 MW in 2021 to almost 4,000 MW in 2045.

- Wind offshore is projected to grow from 1,700 MW in 2021 to 33,900 MW in 2045. The Scottish Government ambitions for 8,000-11,000 MW of offshore wind capacity by 2030 is not met in the System Transformation scenario. We modified the scenario to meet this target by inserting an installed capacity of 9,500 MW for offshore wind by 2030, in order to test the system under the conditions that this target is achieved.

- Wind onshore is projected to grow from 8,900 MW in 2021 to 23,900 MW in 2045.

Installed storage capacity

Figure 6 Installed storage capacity in Scotland under the System Transformation scenario.

- Pumped storage hydroelectric installed capacity forms the majority of installed storage capacity in Scotland in 2021. It is projected to rise to above 2,000 MW by 2040. There are several potential pumped storage projects in the pipeline: Coire Glas 1,500 MW [17], Red John 450 MW [18], and Corrievarkie 600 MW [19].

- Battery storage is projected to increase substantially from 124 MW in 2021 to 1,800 MW in 2030, followed by more modest growth to 2,100 MW by 2045.

- Compressed air energy storage (CAES) and liquid air energy storage (LAES) are also projected to have increasing capacity from 0.9 MW of CAES and 1.4 MW of LAES in 2021 to 1,100 MW of CAES and 553 MW of LAES in 2045.

The timescale of usage of these electrical storage types is constrained by the time it takes for each technology to fully discharge at full power. Batteries in FES are assumed to be suited to intra-day charging/discharging cycles. Pumped storage, CAES, and LAES are assumed to be capable of charging or discharging at maximum output for a longer period of time. These storage types are suited to system balancing on seconds, hours, and days timescales but these, bar pumped storage, are unlikely to be used for long-duration storage where balancing is required on weeks and months timescales due to a prolonged period of low VRE output. The FES scenarios mainly rely on hydrogen as a storage medium for these longer timescales.

Peak demand

Figure 7 shows the projected peak electricity demand in Scotland under the System Transformation scenario. There is a steady increase in peak demand from 4,600 MW[7] in 2021 to 8,700 MW in 2045.

Figure 7 Peak electrical demand during GB-wide average cold spell in Scotland under the System Transformation scenario.

The System Transformation scenario assumes that most heating is met by Hydrogen[8] (see Appendix 12.8), which results in a lower peak demand than in Consumer Transformation (heating is primarily electrified). The Consumer Transformation peak electricity demand for Scotland in 2045 is 11,300 MW due to most heating being met by electrification through heat pumps. This peak is 2,600 MW higher than the System Transformation assumption.

The peak demand shown here does not include electrical demand from electrolysers producing hydrogen. FES analysis assumes that electrolysers can be turned off during peak demand, and therefore, do not need to be included in calculations for security of supply metrics. However, our analysis does include this demand for power flow analysis and import and export calculations.

Transfer capability and interconnectors

The only interconnector from Scotland to outside GB is currently the Moyle interconnector to Northern Ireland. The Moyle interconnector was limited in transfer capability to 160 MW in 2021, but from 2022 has increased to its full capacity of 500 MW. We used the Consumer Transformation projections for interconnection expansion which includes a 700 MW connection to Norway by 2035 in addition to the 500 MW Moyle interconnector. This modification was made to ensure the baseline includes a higher interconnection for Scotland, and then a stress test on the unavailability of interconnectors could explore the impact on security of supply of no connection with Northern Ireland and Norway.

Transfer capability across the B6 boundary is projected to increase about four-fold from 6,100 MW in 2021 to 24,700 MW in 2040 for the System Transformation scenario. This increase is to enable power flow from the increased wind generation in Scotland to the rest of GB. Power flow to Scotland will be lower than from Scotland, so does not affect the transfer capability requirements. This scenario projection is substantially higher than increases in the Network Options Assessment (NOA) due to higher projections for installed capacity of renewable generation in Scotland. National Grid’s Electricity Ten Year Statement [7] includes more details on the future boundary transfer capability requirements for the B6 boundary which connects Scotland’s transmission network to the rest of GB.

Measuring security of supply

This report focuses on capacity adequacy as a measure of security of supply, which ensures that we always have enough energy to meet our needs. National Grid ESO publish capacity adequacy analysis for the GB system, often in its winter outlooks and FES reports. Given the scope of this work, a similar standard approach is used, with a focus on the Scotland system. The interaction with the rest of the GB system is modelled as flow across the boundaries.

The GB standard for generation adequacy uses the Loss of Load Expectation (LOLE) as the indicator of supply reliability, complemented by other relevant risk metrics which are detailed in Appendix 12.10. LOLE is defined as the expected number of hours over a period in which supply resources are insufficient to meet demand. It provides a measure of security of supply over a statistically long-term period, such as a year. The current reliability standard for LOLE in GB is set to no more than three hours in a year.

De-rated system margin is used as a proxy for risk of loss of supply. It is more useful as a measure of security of supply than installed capacity, as it accounts for the probability of a forced outage.

Security of supply metrics for System Transformation

De-rated system margin

An overview of the forecasted de-rated margin for Scottish system in the System Transformation scenario is shown in Figure 8. While peak demand sees steady growth, it is exceeded by the increase in available firm capacity (including the equivalent firm capacity of VRE) that can serve peak demand with high probability.

Figure 8 of de-rated supply capacity, peak demand and supply margin of Scotland for System Transformation from 2025 – 2045

The de-rated system margin increases from 2,200 MW in 2025 up to 12,200 MW in 2045. The capacity of wind shown in Figure 8 are de-rated using equivalent firm capacity factors (ranging between 13-17% in recent NG reports [20] [21] [22]). This represents the wind generators contribution to security of supply at stress events. Due to the significant amount of onshore and offshore wind added into the system, from 2035 onwards the de-rated wind capacity alone is higher than the peak demand. This ensures a very high level of de-rated system margin.

The GB supply margin under System Transformation can be found in Appendix 12.11.

Loss of load expectation

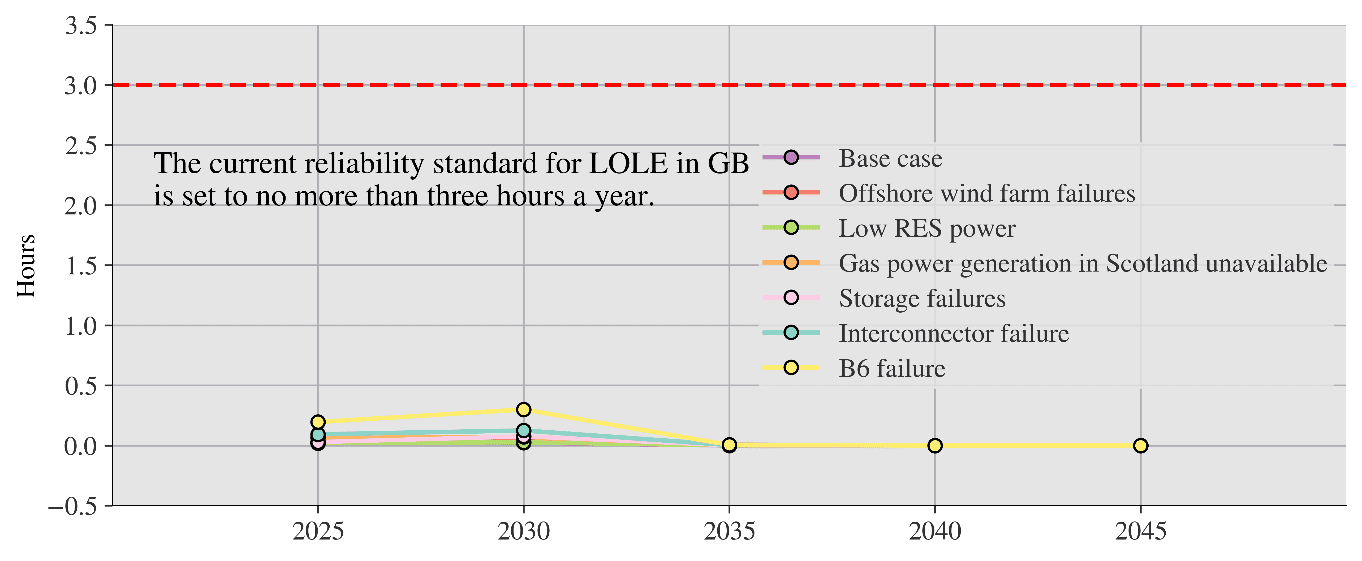

Figure 9 LOLE results for System Transformation in Scotland from 2021 – 2045

In line with the high de-rated system margin the calculated LOLE of Scotland’s electrical system stays at a very low level for the System Transformation scenario in all modelled years. The lower the LOLE number, the lower the risk of insufficient generation to meet demand. From our results, the LOLE increases marginally from 0.020 hours per year in 2025 to 0.023 in 2030. The increase is due to the anticipated closure of nuclear power stations over the 5-year period. This is still significantly below the 3 hours currently allowed in the GB reliability standard. The rise in LOLE between 2025 and 2030 could be higher but the addition of 7,870 MW wind capacity during this period helps to mitigate the effects of phasing out nuclear generation.

LOLE values from 2035 onwards are less than 0.0001, and so low that statistically the loss of load can be considered highly unlikely. This very low LOLE from 2035 is attributed to the significant influx of new electricity generation of various types in the Scottish system in the System Transformation scenario, e.g., Scotland’s wind capacity is projected to increase by over 25,000 MW, reaching 49,400 MW in 2035[9], the largest increase over a 5-year period in the scenario. Even with an Equivalent Firm Capacity (EPC) factor of 16.1%, wind energy alone is enough to provide reliable generation equivalent to 8,400 MW, enough to meet Scotland’s peak demand of 6,000 MW in 2035. The addition of biomass, Hydrogen, and pumped storage capacity from 1,223 MW in 2035 to 4,648 MW in 2040 significantly increases the dispatchable electricity sources in Scotland. This also exceeds the Scottish demand growth (1,500 MW) during that period, further enhancing supply security.

In practice, the actual target LOLE for the GB system operator has been less than 3 hours. The LOLE reported in National Grid’s Winter Outlook in 2021 and 2022 was 0.3 and 0.2 hrs/year for the GB system. The Scottish electrical system is modelled to have a lower LOLE than the GB system. In 2021 the Scottish LOLE was modelled as 0.108 hrs/year and this is expected to further decrease in the future.

Power dispatch

Power dispatch is the cost-optimised mechanism by which power needs and demands are balanced. Power dispatch modelling can be used to illustrate security of supply by demonstrating how generation and storage are being used to meet demand. Power dispatch modelling outputs are for the same 2-day peak period in 2045[10]. Interconnectors are included in the power flow calculation but excluded from modelled output figures to provide focus on the role of generators and storage.

Figure 10 shows the power dispatch of the Scottish electricity system for generation, storage, and export at the B6 boundary (where Scotland connects with the rest of GB) for the System Transformation scenario. Offshore and onshore wind power dominate generation, and there are large power export flows across the B6 boundary to the rest of GB. Storage technologies and biomass are dispatched, while exports continue to the rest of GB, during this high demand period. The equivalent power dispatch at the same peak period for GB[11] can be found in Appendix 12.11.

Figure 10 Power dispatch of Scotland for System Transformation in 2045 over 2-day peak period.

Imports and exports

Scotland supports the overall GB system with net exports of power across the B6 boundary. Figure 11 and Figure 12 show the monthly import (from rest of GB to Scotland) and exports (from Scotland to rest of GB) across the B6 boundary. Outputs were obtained by running the model with historical data for 2021 and the System Transformation scenario for 2045. Scotland is a net exporter to the rest of GB and exports will increase in future[12]. There will also be an increase in the level of import from the rest of GB to Scotland which could be due to increased demand coupled with increased reliance on intermittent power generation. The level of import and export have a seasonal pattern, with higher imports in the summer and higher exports in the winter. This is due to higher wind generation and demand in winter than in summer which results in more opportunities to export to the rest of GB.

Figure 11 B6 monthly import in 2021 and 2045 under the System Transformation scenario

Figure 12 B6 monthly export in 2021 and 2045 under the System Transformation scenario

Stress testing Scotland’s security of supply

Our modelling has shown that Scotland’s electricity system has a low probability of being unable to meet demand in the modelled years. However, the assumptions are based on a particular set of conditions and do not account for the full range of possible situations. Stress tests were used to test the security of supply of the Scottish electricity system beyond the original scenario conditions (Figure 13).

Figure 13 Network map of Scotland and stress tests scenarios

These are summarised relative to the System Transformation scenario base case in Table 3.

Table 3 Summary of assumptions used in stress testing scenarios

|

Scenario |

Description |

|

Base case |

The System Transformation scenario. |

|

Offshore wind farm failures |

Removes the contribution from offshore wind farms in Scotland with a worst-case assumption of 21,000 MW loss. |

|

Low VRES power output |

The contribution of VRE generators (onshore and offshore wind, PV, and hydro) in Scotland is limited to 20% of their potential outputs. |

|

Gas power generation in Scotland unavailable |

The generation capacity of CCGT, including CCS, in Scotland are set to zero. |

|

Interconnectors to NI and Norway unavailable |

Interconnector failure including both Scottish links to Norway and Northern Ireland. |

|

Storage failures |

The installed capacity of batteries in Scotland are set to zero. |

|

Connection to rest of GB unavailable |

The connection of Scotland to rest of GB across the B6 boundary is unavailable. |

We investigate the power flow for each of the stress tests and the security of supply metrics up to 2045. We also analyse the impact on imports and exports from/to Scotland. All stress tests are applied for 3 days either side of peak demand. All the stress events are applied to the base case independently, and are assumed to last the whole week in which the peak demand occurs.

Security of supply for the stress tests

Full outputs from stress tests can be found in Appendix 12.12. Figure 14 summarises the LOLE for all the stress test cases. During peak demand periods, the impact of unavailability of supply are higher than other times of the year. The LOLE for all stress tests is within the three hours/year reliability standard, and are below the modelled 2021 Scottish LOLE of 0.108 hrs/year, except for B6 failure in 2025 and 2030 and interconnector failure in 2030. The system from 2035 onwards is very secure with a low LOLE.

In 2025 and 2030 the stress test of disconnection with the rest of GB has the highest impact on the security of supply as measured by LOLE, followed by unavailable interconnectors and gas supply issues. This implies that the reliance of import from the rest of GB in maintaining the capacity adequacy in Scotland is more than the other supply types. However, its significance becomes negligible from 2035 due to a large increase in offshore wind capacity in the Scottish system and additional capacity from battery storage, pumped hydro, Hydrogen power plant, and biomass in subsequent years.

(a)

(b)

Figure 14 (a) LOLE for Scotland in the stress test cases (2025–2045); (b) GB 3h/yr limit added for comparison

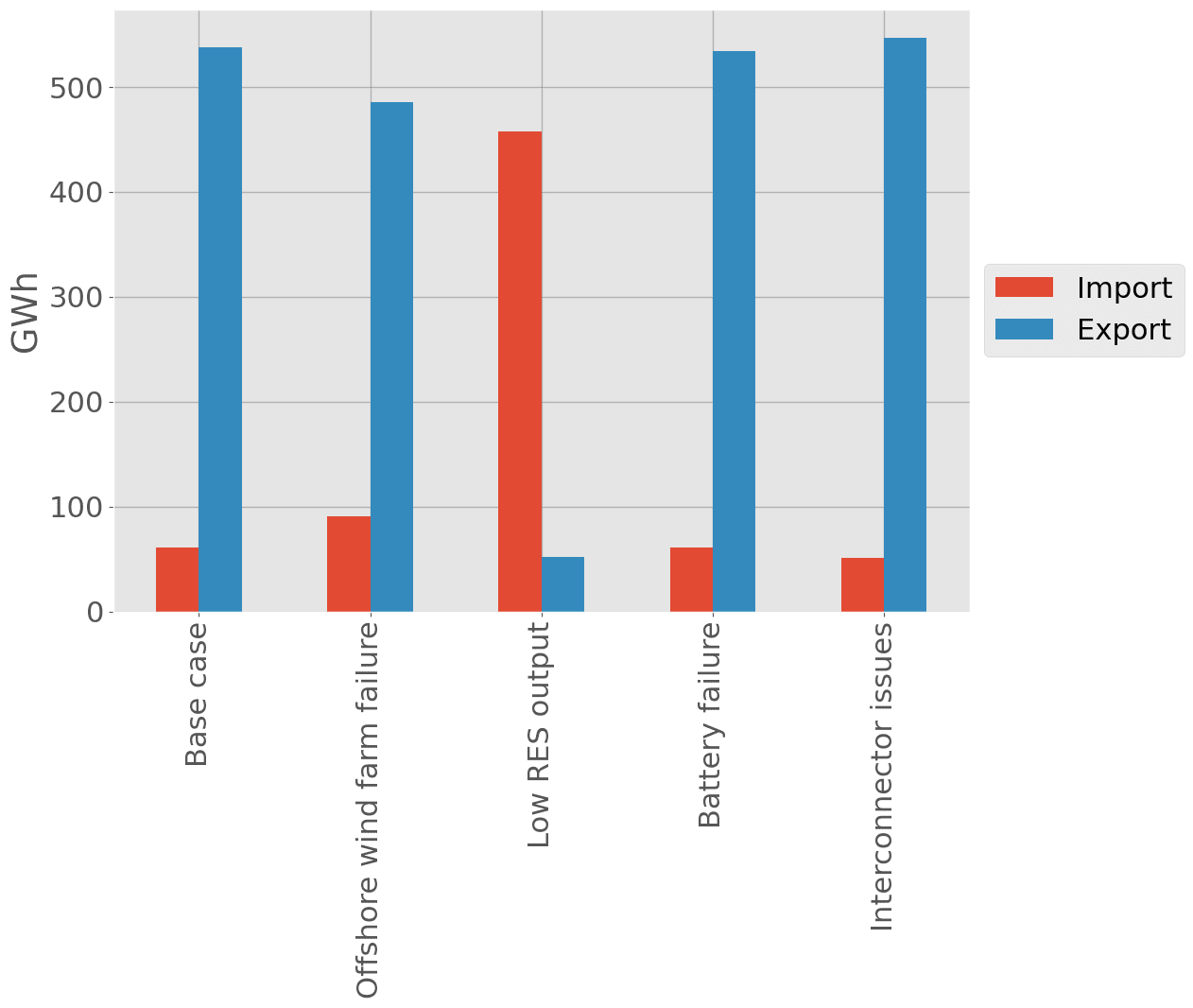

Import and export for the stress tests

The stress tests have impacts on the imports and exports across the B6 boundary between Scotland and the rest of GB. Countries in Europe increasingly exchange power with each other, particularly to share cheap abundant electricity, as has been the case historically with France exporting nuclear power to central Europe and Denmark exporting wind power to Norway who can store this in their large pumped hydro schemes. Scotland shares an electricity market with the rest of GB but imports and exports are a useful measure of the dependence on the power exchange across the B6 boundary.

Figure 15 shows for each stress test the total import and export across the B6 boundary over the 6-day period the stress tests are applied, including the peak GB demand period in the middle of the 6 days. The base case in 2045 sees increases in imports due to closure of Torness nuclear power plant and reduced capacity of Peterhead.

Figure 15 Import and export for the stress tests across the B6 boundary

The stress tests for offshore wind farm failures, gas power generation in Scotland unavailability, battery failures, and interconnector issues result in increased imports into Scotland. The low VRES output stress test sees Scotland become a net importer over the 6-day period modelled. The following findings are identified:

- Offshore wind farm failures reduce total wind generation over the period resulting in higher imports and lower exports.

- The low VRES period reduces total wind generation by a greater degree than the offshore wind farm failure meaning that there are more imports than exports.

- Gas supply issues reduce the capability of Scotland to provide firm generation over the 6-day period, resulting in more periods where imports from the rest of GB are required, typically when there is low wind generation. This has minimal impact on imports and exports during the modelled period.

- Battery failure decreases the ability of the system to store excess renewable power generation to be utilised later during low VRES periods. This has minimal impact on imports and exports during the modelled period.

- Interconnector issues reduces exports of excess wind generation to Norway or Northern Ireland, at the same time as reducing imports from these countries to meet demand when there are higher electricity prices in Scotland. The result is slightly increased imports, and increased exports which are exported to the rest of GB rather than to Norway or NI.

Overall, the low VRES output period has the largest impact on imports and exports from/to Scotland, followed by the offshore wind farm failures. This highlights the importance of wind power generation in the future Scotland electricity system. Interconnectors to NI and Norway have the next biggest impact, but this will likely be more impactful under other FES scenarios which see larger increases in interconnector capacity. The battery failure and gas supply issues have minimal impact on the imports and exports in the modelled period.

Self-sufficient Scotland

In this section we assess the impacts of Scotland having an entirely self-sufficient future electrical system. We modified our original model (Table 3) to consider Scotland as an isolated electrical network in the self-sufficient base case. All interconnections to Northern Ireland and Norway and all transmission links to the rest of GB across B6 were removed. After calculating the LOLE in this new base case, we conducted a stress test. We also stress test with low VRES power[13] and examine the additional capacity required to reduce LOLE to the 3-hour GB reliability standard.

Figure 16 LOLE of self-sufficient Scotland system in base case, low renewable output stress case and with additional firm capacities

The changes in level of capacity adequacy for a self-sufficient Scotland is given in Figure 16. Violation of the 3 hours GB standard occurs in the base case in the years 2025 and 2030, but the LOLE is less than 0.18 hours in 2035 and decreases in the following years. Figure 16 also shows the additional firm capacity needed to reduce the LOLE in 2030 to within the minimum required 3 hours, and to a more conservative range, for example, the 0.3 hours reported in the 2022 Winter Outlook[14].

To achieve LOLE of 3 or 0.3 hours an additional 250 MW or 1000 MW equivalent firm capacity is needed respectively. Several alternative supply types can each provide an equivalent (de-rated) 250 MW of additional firm capacity:

- 274 MW installed capacity of CCGT with CSS.

- 380 MW battery storage 3 hours storage duration of 1140 MWh.

- 1,553 MW of installed capacity of offshore wind.

For 1000 MW additional firm capacity:

- 1,095 MW installed capacity of CCGT with CCS.

- 1,510 MW battery storage with 3 hours storage duration of 4,530 MWh.

- 6,211 MW of installed capacity of offshore wind.

The increase in offshore wind capacity in the base case is much higher than the additional installed capacity of wind required above. Therefore, as shown in Figure 17, the LOLE in 2035 is well within the acceptable range.

In a self-sufficient Scotland the share of wind in the total supply mix becomes more significant. Under the low VRES power output stress test, the LOLE increases to 6.8 hours in 2025 and 5.6 in 2030 but decreases to 0.32 hours in 2035 and reduces further in 2040 and 2045. The low LOLE in 2035 is due to a 25,000 MW increase in installed wind capacity from 2030.

Even after scaling down to 20% of VRES potential power output, there is still enough contribution from wind generation to serve the peak demand. Increases in biomass, hydrogen, and pumped storage capacity in 2040 and 2050 make non-variable supply alone sufficient to meet peak demand, further reducing the LOLE in the later years under the low VRES stress case. With 400 MW additional firm capacity can bring the LOLE to within 3 hours in 2025 and 2030. This is 150 MW more than is needed in the self-sufficient base case.

Black start capability

Removing interconnections and links to England may result in the loss of access to generators that are capable of providing black start. However, it does not necessarily imply that the black start capacity in Scotland is insufficient. The System Transformation scenario projects a significant increase in the capacity of hydro, battery storage, and pump-hydro storage in Scotland, which offer good black start capabilities. These sources have a combined capacity of 4,368 MW in 2030, which will increase to 6,023 MW in 2045, accounting for more than half of peak demand. Whether these assets are sufficient for black start depends on conducting simulations or tests of the system under various scenarios. It is also crucial to regularly review and update the black start procedures to ensure that they remain effective and relevant.

Low capacity and high demand scenario

We further tested the system, modifying the base case (System Transformation) scenario by removing future thermal power plants (i.e., hydrogen, gas and biomass CCS); using the more conservative ETYS21 [7] assumptions on B6 boundary expansion; and increasing peak demand to those in the Consumer Transformation Scenario. Table 4 shows the resulting modifications to the base case (see Appendix 12.18 for full dataset). We then show results for the de-rated system margin, LOLE, stress tests, and imports and exports.

Table 4 Modifications to System Transformation Base Case for the low capacity and high demand scenario

(Base Case capacities in brackets)

|

Installed capacity (MW) |

2021 |

2030 |

2035 |

2040 |

2045 |

|

Gas (including CCS) |

1,238 |

0 (969) |

0 (969) |

0 (910) |

0 (1,810) |

|

Biomass |

208 |

251 |

230 |

230 (1,946) |

230 (1,894) |

|

Hydrogen |

0 |

0 (43) |

0 (43) |

0 (690) |

0 (1,924) |

|

B6 connection |

6,100 |

11,500 (17,604) |

16,900 (22,238) |

16,900 (24,662) |

16,900 (24,662) |

|

Peak demand in Scotland |

4,600 |

5,900 (5,200) |

8,000 (6,000) |

10,200 (7,500) |

11,300 (8,700) |

De-rated system margin

In the low capacity and high demand scenario, the de-rated system margin increases from 1,400 MW in 2025 to 4,500 MW in 2045, with a decrease in 2030 due to the assumed closure of all gas and nuclear generation in Scotland between 2025 and 2030. In the base case scenario, the gas CCS generation would have provided an additional de-rated capacity of approximately 1,600 MW in 2045.

The de-rated margin as a percentage of peak demand under the low capacity and high demand scenario between 2025 and 2045 is on average 32%. This is lower than the average 90% under the original base case scenario.

Figure 17 Installed firm generation capacity (GW) in Scotland under the low capacity and high demand scenario.

Loss of load expectation

Figure 18 LOLE results for low capacity and high demand scenario in Scotland from 2021 – 2045. GB Reliability standard 3hrs/y

The LOLE of the low capacity and high demand scenario, as illustrated in Figure 18, is considerably higher than the base case scenario (Figure 9) in all future years.

The year 2030 shows a significant increase in LOLE due to the closure of all gas and nuclear power stations, resulting in a LOLE of 6.3 hours/year which is higher than the GB reliability standard of 3 hours/year. Potential options for addressing this include keeping gas generation running for additional years while waiting for further renewable generation deployment or incentivising the development of additional storage and renewable generation before 2030.

By 2035 the subsequent strong growth of renewable generation capacity brings the LOLE back below the GB reliability standard. This is particularly due to an additional offshore capacity of approximately 17,300 MW from 2030 to 2035. As wind generation and storage capacity continue to increase, LOLE drops further from 2 hours in 2035 to 1.2 hours in 2045.

The lowest LOLE in the low capacity and high demand scenario is 1.2 hours/year in 2045, while in the original base case scenario, it is 0.0001 hours/year. This difference can be attributed to the exclusion of natural gas, hydrogen, and biomass, as well as higher demand. LOLE after 2030 in the low capacity and high demand scenario is relatively high compared to historical Scottish LOLE, such as 0.108 hrs/year in 2021. While this shows an increased risk of interruption to supply, it does not necessarily imply that such a shortage event will occur as it is still below the GB reliability standard.

Security of supply for the stress tests

Figure 19 LOLE for Scotland in the stress test cases under the low capacity and high demand scenario (2025–2045). GB Reliability standard 3hrs/y. LOLE 0.108 hrs/y of 2021 Scottish system

Except for the year of 2030 and the case of B6 failure in 2030-2045, all stress tests are within the GB reliability standard of three hours per year, but still greatly exceed the historical Scottish and GB LOLE in 2021, as presented in Figure 19. The disconnection from the rest of the GB stress test as illustrated using the ‘B6 Failure’ case has the most significant impact on the security of supply as measured by LOLE, far more than other test cases. LOLE of the other stress test cases are not significantly different from each other, with the offshore wind farm failure test highest, followed by unavailable interconnectors. This suggests that maintaining capacity adequacy in Scotland is highly dependent on imports from the rest of GB in this scenario.

The role of the B6 connecting Scotland to the rest of GB is more significant for security of supply in the low capacity and high demand scenario compared to the base case (System Transformation) scenario. The import capacity capability to Scotland across the B6 boundary is the main supply source after the renewable generation capacity in Scotland. In contrast, in the base case scenario, there is considerable capacity of CCS gas, biomass, and hydrogen generation, along with the B6 import capability, which can contribute to the security of supply.

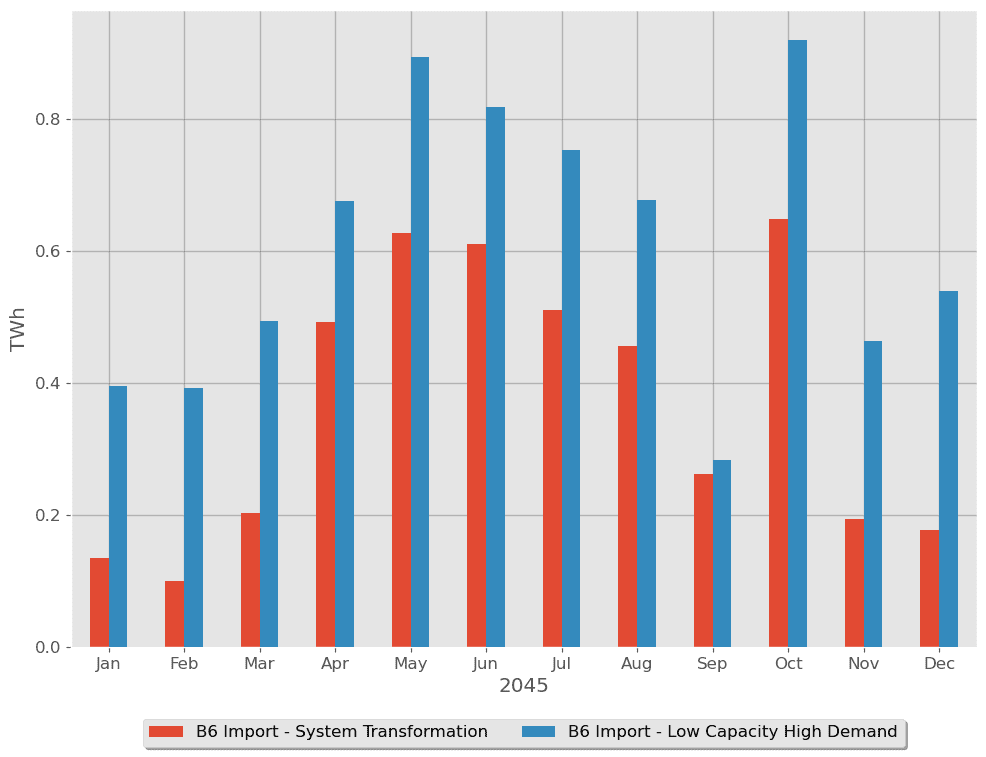

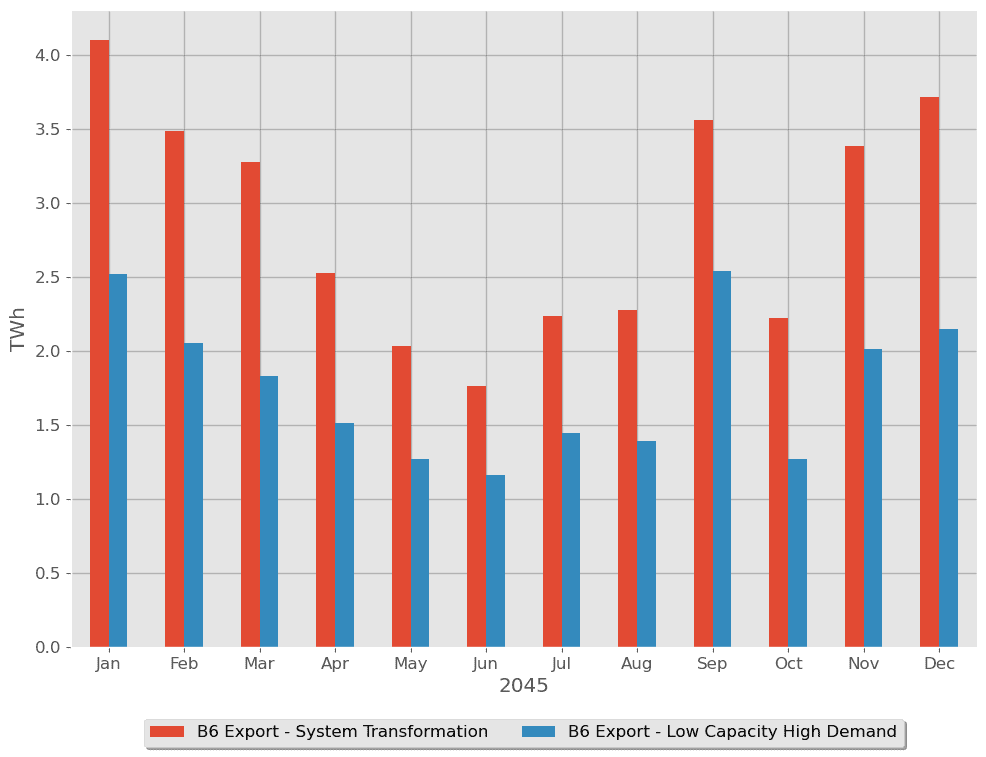

Imports and exports

Imports (from rest of GB to Scotland) are higher and exports (from Scotland to rest of GB) are lower for the low capacity and high demand scenario compared to the base case scenario. This trend is consistent to 2045, which is shown in Figure 20 for imports and Figure 21 for exports. Over the year both scenarios have net exports of power across the B6 boundary. These results are due to the decreased generation and B6 boundary transfer capacity, and further highlight the greater importance of the B6 boundary in the low capacity and high demand scenario for security of supply.

Figure 20 B6 monthly import in 2045 under the base case and low capacity and high demand scenario

Figure 22 shows the import and exports for the stress tests for the low capacity and high demand scenario. There is a reduced level of exports in these stress periods compared to the System Transformation base case, due to the lower generation capacity from hydrogen, gas CCS, and biomass. The greater reliance on VRES and the B6 boundary is highlighted by the high levels of import required for the low RES output stress test.

Figure 22 Import and exports in 2045 for 6-day period for stress tests in low capacity and high demand scenario

Conclusions

Lessons learned from national and regional electricity systems operating with close to 100% renewable energy sources:

- Several national and regional electricity systems operate at, or close to, 100% renewable electricity. However, these countries typically rely on dispatchable (non-VRE) renewable sources such as hydropower and storage reservoirs to generate and store electricity. These dispatchable renewable resources are only available at the required scale in a few countries. In Scotland, the most available renewable resource is wind, which is a variable source of energy.

- There are fewer examples of national electricity systems that operate with a high proportion of variable wind and solar energy shares. Denmark has the highest overall share of renewable electricity at 84%, with a high proportion from variable renewable sources and wind at 60% of total electricity production.

- Scotland has high wind generation, which makes up around 49% of total electricity generation, and relies on imports and exports with the rest of GB. It is most closely comparable to Denmark, which also makes extensive use of connection to neighbouring countries.

Changes to electricity market arrangements:

- Current GB electricity market arrangements are not suited to the net zero transition and potential reforms have been set out, which can enable a fully decarbonised electricity system by 2035. It is too early in the process to see a path for which reforms will be implemented and specify the impact they will have on security of supply.

- Splitting the wholesale market could improve the long-term sustainability of investing in renewable power in Scotland. However, it is possible that other reform proposals can provide the benefits outlined, and there could be a lack of additionality.

- Locational pricing might have the impact of depressing prices received by generators in Scotland as locational prices could be higher in England than in Scotland. Wind farms may require additional subsidy to be built in Scotland under locational pricing.

- A potential enhanced capacity market should take account of the issues specific to Scotland, while the Scottish Government should be an important stakeholder in strategic reserve decisions.

Technology pathway to net zero in Scotland in 2045:

- We have analysed the technology pathway according to the System Transformation scenario out to 2045 for Scotland. We found that security of supply metrics for Scotland in this scenario is well within the current GB reliability standards and comparable to current levels.

- There will be a reduction in traditional firm generation capacities (no nuclear and CCGT power plant generation capacity reduced when changing to CCS technology). However, these losses are offset by vast increases in wind and solar installed capacity, which can still provide security of supply, as well as increasing low-carbon firm generation capacity in the form of biomass, hydrogen and CCGT, with CCS power plants closer to 2045. Security of supply is further enhanced by the installation of battery, pumped hydro, liquid air and compressed air energy storage.

- Peak demand in Scotland is expected to rise to around 9,000 MW by 2045 but the de-rated system margin still increases from 2,200 MW in 2025 up to 12,200 MW in 2045, which shows there is sufficient firm generation. This was further verified by power dispatch simulation.

- The future Scottish electricity system has security of supply under the System Transformation scenario, but this cannot be directly assumed for the rest of GB supply and demand will likely continue to be balanced at GB-level by National Grid as the energy system operator. Therefore, while the generation capacity in Scotland may seem excessive in the context of security of supply, it will be utilised to decarbonise the rest of GB’s electrical system.

- We have further tested the future Scottish electricity system by modifying the System Transformation scenario: removing future thermal power plants; using more conservative B6 boundary expansion assumptions; and increasing peak demand. In this low capacity and high demand scenario security of supply in 2030 is worse (LOLE of 6.3 hours/year) than the GB reliability standard (LOLE of 3 hours/year).

- Beyond 2030 security of supply increases in the low capacity and high demand scenario but is relatively high compared to historical Scottish security of supply.

- Except for the year of 2030 and B6 failure in 2030-2045, all stress tests are within the GB reliability standard of three hours per year, but still greatly exceed the historical Scottish and GB security of supply in 2021.

Imports and exports between Scotland and the rest of GB:

- The System Transformation scenario requires a four-fold increase in transfer capability between Scotland and the rest of GB, from 6,100 MW in 2021 to 24,700 MW in 2045.

- Scotland will continue to be a net exporter to the rest of GB, and both total and net exports will increase. There are periods when Scotland will import only because it is economic to do so, rather than due to lack of local supply. There will be an increase in the level of import from the rest of GB due to increased demand coupled with the increased reliance on wind power generation.

- A period of low wind and solar generation has the largest impact on imports and exports from/to Scotland, followed by offshore wind farm failures. This highlights the importance of wind power generation in the future Scotland electricity system.

- Problems with interconnectors to Northern Ireland and Norway have the next biggest impact, but this will likely be more impactful if we see larger increases in interconnector capacity. Battery failure and gas supply issues have minimal impact on the imports and exports in the modelled period.

- Imports from rest of GB to Scotland are higher and exports from Scotland to rest of GB are lower for the low capacity and high demand scenario than for the System Transformation scenario. High levels of import are required for the low RES output stress test, illustrating the greater reliance on VRES and the B6 boundary in this scenario.

A self-sufficient Scotland:

- A self-sufficient Scotland with no connection to the rest of GB and no interconnector capacity to Northern Ireland or Norway was found to violate the 3 hours GB reliability standard in the years 2025 and 2030. However, by 2035 the reliability is within historical values and decreases in the following years.

- We find 250 MW and 1000 MW of additional equivalent firm capacity is needed in 2025 and 2030 to meet the reliability standard of 3 hours or recent values of 0.3 hours respectively. This can be achieved with the addition of 1,553 MW (to meet 3 hours) and 6,211 MW (to meet 0.3 hour) of installed capacity of offshore wind.

- The projected system beyond 2040 can meet reliability standards even after scaling down wind and solar generation to 20% of its potential output around the peak demand period. 400 MW additional equivalent firm capacity can bring the reliability standard to within 3 hours in 2025 and 2030, which is only 150 MW more than is needed in the self-sufficient System Transformation base case.

References

|

[1] |

Scottish Parliament, “Climate Change (Scotland) Act,” 2009 (Amended 2019). [Online]. Available: https://www.legislation.gov.uk/asp/2009/12. [Accessed February 2023]. |

|

[2] |

“Offshore wind policy statement,” 2020. [Online]. Available: https://www.gov.scot/publications/offshore-wind-policy-statement/. |

|

[3] |

National Grid ESO, “Future Energy Scenarios (FES 2022),” 2022. [Online]. Available: https://www.nationalgrideso.com/future-energy/future-energy-scenarios. |

|

[4] |

“Climate Change Plan update 2020,” [Online]. Available: https://www.gov.scot/publications/securing-green-recovery-path-net-zero-update-climate-change-plan-20182032/. |

|

[5] |

“ScottishPower completes black start project using 69-MW wind farm,” 2020. [Online]. Available: https://renewablesnow.com/news/scottishpower-completes-black-start-project-using-69-mw-wind-farm-719904/. |

|

[6] |

National Grid ESO, “Black Start from Non‑Traditional Generation Technologies,” [Online]. Available: https://www.nationalgrideso.com/document/148201/download. |

|

[7] |

National Grid ESO, “Electricity Ten Year Statement,” 2021. [Online]. Available: https://www.nationalgrideso.com/research-publications/etys. |

|

[8] |

P. Denholm and D. J. Arent, “The challenges of achieving a 100% renewable electricity system in the United States,” Joule, vol. 5, no. 6, 2021. |

|

[9] |

B. Kroposki and B. Johnson, “Achieving a 100% Renewable Grid: Operating Electric Power Systems with Extremely High Levels of Variable Renewable Energy,” IEEE Power and Energy Magazine, vol. 15, no. 2, pp. 61-73, 2017. |

|

[10] |

T. Mai, P. Denholm, P. Brown and W. Cole, “Getting to 100%: Six strategies for the challenging last 10%,” Joule, vol. 9, p. 6, 2022. |

|

[11] |

W. Zappa, M. Junginger and M. van den Broek, “Is a 100% renewable European power system feasible by 2050?,” Applied Energy, no. 233-234, 2019. |

|

[12] |

D. Bogdanov, J. Farfan and K. Sadovskaia, “Radical transformation pathway towards sustainable electricity via evolutionary steps,” Nature Communications, 2019. |

|

[13] |

“Energy Statistics for Scotland Q1 2021 Figures,” [Online]. Available: https://www.gov.scot/binaries/content/documents/govscot/publications/statistics/2018/10/quarterly-energy-statistics-bulletins/documents/energy-statistics-summary—june-2021/energy-statistics-summary—june-2021/govscot%3Adocument/Scotland%2BEnergy%2BStat. |

|

[14] |

“Q4 2020: Record Wind Output And Curtailment,” [Online]. Available: https://reports.electricinsights.co.uk/q4-2020/record-wind-output-and-curtailment/#:~:text=3.8%20TWh%20of%20electricity%20was,power%20every%20home%20in%20Wales.&text=Between%202015%20and%202019%2C%20curtailment,around%20%C2%A310%20per%20household.. |

|

[15] |

BEIS, “Review of electricity market arrangements,” [Online]. Available: https://www.gov.uk/government/consultations/review-of-electricity-market-arrangements. |

|

[16] |

“ PyPSA-GB:: An open source model of the GB power system for simulating future energy scenarios,” 2022. [Online]. Available: https://pypsa-gb.netlify.app/. |

|

[17] |

Coire Glas, “The Case for Pumped Hydro Storage,” [Online]. Available: https://www.coireglas.com/. |

|

[18] |

“Red John Pumped Storage Hydro Scheme,” [Online]. Available: https://www.redjohnpsh.co.uk/. |

|

[19] |

“Corrievarkie Pump Storage Hydro Scheme,” [Online]. Available: http://www.corrievarkiepsh.co.uk/. |

|

[20] |

National Grid ESO, “De-rating Factor Methodology for Renewables Participation in the Capacity Market,” 2019. [Online]. Available: https://www.emrdeliverybody.com/Prequalification/EMR%20DB%20Consultation%20response%20-%20De-rating%20Factor%20Methodology%20for%20Renewables%20Participation%20in%20the%20CM.pdf. |

|

[21] |

National Grid ESO, “ Electricity Capacity Report 2021,” [Online]. Available: https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/Electricity%20Capacity%20Report%202021.pdf. |

|

[22] |

National Grid ESO, “Winter Outlook 2022/23,” [Online]. Available: https://www.nationalgrideso.com/research-publications/winter-outlook. |

|

[23] |

International Energy Agency (IEA), “IEA Global energy review 2021,” [Online]. Available: https://www.iea.org/reports/global-energy-review-2021. |

|

[24] |

IRENA, “Renewable energy statistics 2021,” [Online]. Available: https://www.irena.org/publications/2021/Aug/Renewable-energy-statistics-2021. |

|

[25] |

Royal Norwegian Ministry of Petroleum and Energy, “Security of electricity supply,” 2019. [Online]. Available: https://energifaktanorge.no/en/norsk-energiforsyning/forsyningssikkerhet/#operational-security. |

|

[26] |

eurostat, “Production of electricity by source 2020 in the EU,” [Online]. Available: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-3b.html?lang=en. |

|

[27] |

Danish Energy Agency, “Development and Role of Flexibility in the Danish Power System,” 2022. [Online]. Available: https://ens.dk/sites/ens.dk/files/Globalcooperation/development_and_role_of_flexibility_in_the_danish_power_system.pdf. |

|

[28] |

“ReFLEX Orkney,” [Online]. Available: https://www.reflexorkney.co.uk/. |

|

[29] |

“’Postcode Pricing’ threatens GB renewable energy growth,” [Online]. Available: https://www.scottishrenewables.com/news/1049-postcode-pricing-threatens-gb-renewable-energy-growth. |

|

[30] |

National Grid ESO, “New ESO report finds electricity market reform critical for delivery of future system that is affordable, secure and clean,” [Online]. Available: https://www.nationalgrideso.com/news/new-eso-report-finds-electricity-market-reform-critical-delivery-future-system-affordable. |

|

[31] |

Energy System Catapult, “Locational energy pricing in the GB power market,” [Online]. Available: https://es.catapult.org.uk/report/locational-energy-pricing-in-the-gb-power-market/. |

|

[32] |

Climate Change Committee, “Delivering a reliable decarbonised power system,” CCC, 2023. |

|

[33] |

National Grid, “Regional insights from the Future Energy Scenarios,” 2022. [Online]. Available: https://www.nationalgrideso.com/document/266366/download. [Accessed February 2023]. |

|

[34] |

Scottish Government, “Hydrogen Action Plan,” 2022. [Online]. Available: https://www.gov.scot/publications/hydrogen-action-plan/. [Accessed February 2023]. |

|

[35] |

R. Billinton and R. N. Allan, “Reliability Evaluation of Power Systems,” [Online]. Available: https://link.springer.com/book/10.1007/978-1-4899-1860-4. |

|

[36] |

“Scottish energy statistics hub,” [Online]. Available: https://www.gov.scot/publications/scottish-energy-statistics-hub-index/. |

|

[37] |

“Orkney Islands Use Renewables to Generate 103% of Power Needs,” [Online]. Available: https://www.engineering.com/story/orkney-islands-use-renewables-to-generate-103-of-power-needs. |

|

[38] |

Open Energy Modelling Initiative, 2022. [Online]. Available: https://openmod-initiative.org/. |

|

[39] |

National Grid ESO, “Electricity Ten Year Statement (ETYS) 2022 Appendix B Supplementary Technical Data,” 2022. [Online]. Available: https://www.nationalgrideso.com/document/275586/download. |

|

[40] |

Department for Energy Security and Net Zero, “National statistics – Energy Trends: UK renewables,” 2022. [Online]. Available: https://www.gov.uk/government/statistics/energy-trends-section-6-renewables. |

Appendices

2022/23 Winter Outlook

The 2022/23 winter outlook was developed amid unprecedented volatility in energy markets and concerns around shortfalls in gas supply. Additional scenarios were added to explore the potential impact of reductions in available electrical capacity from gas power plants and import capability through interconnectors. The National Grid report found that under the base case that there will be adequate security of supply with a de-rated margin of 3,700 MW (6.3%) in GB system which is in line with recent years (see Figure 23).

Two additional scenarios were presented in the 2022/23 winter outlook: 1) no electrical imports from continental Europe (Ireland and Norway interconnectors remained available); and 2) in addition to this, 10GW of CCGT being unavailable. Scenario 2 led to security of supply concerns and as a result 2GW of coal power plants and a 2GW novel demand flexibility service were brought into contingency planning.

Figure 23 De-rated margins from National Grid’s recent Winter Outlooks showing the figures for the Winter Outlook 22/23 are in line with historical margins

Ancillary services and system operability

Ancillary services are essential for ensuring the stability and reliability of power system operations, as they maintain frequency and voltage within acceptable ranges and prevent disruptions and blackouts. Unlike fossil-fuel generators, wind turbines and PV panels don’t provide the same level of inertia required to stabilise the system frequency changes following a loss of generation or demand. Ancillary services are not within the scope of the report but are important in understanding the impact of the changing electricity mix on power system operability. To compensate for the lack of inertia in renewable energy sources, modern wind turbines can be equipped with power electronics and control systems that provide synthetic or virtual inertia to the grid. Energy storage systems and other advanced grid technologies can also help balance the system and maintain stability.

National electricity systems with near 100% renewable

Several national electricity systems in the world already operate with, or close to, 100% renewable electricity. For example, Iceland generates all its electricity from either geothermal or hydropower. Other countries with high share of renewable generation include Paraguay (99%), Norway (98%), Uruguay (95%), and Costa Rica (93%) [23] [24]. Despite these impressive levels of renewable generation, there is still some non-renewable electricity generation in each of these countries. In Paraguay, small-scale industrial power plants using sources such as oil, natural gas, and coal contribute to the non-renewable part. In Norway, thermal power plants are the primary source of non-renewable electricity. Both Uruguay and Costa Rica rely on oil-fuelled power plants to support renewables.

The common feature of these countries is that generation from hydropower plants and storage reservoirs dominates the renewable supply. In Norway, many hydropower plants have storage reservoirs. With reservoirs, hydropower production can be adjusted within the constraints set by the watercourse itself. Therefore, they have flexibility which makes it possible to follow the variation of demands, even during periods when there is little rainfall or river inflow.

Blåsjø, Norway’s largest reservoir, has a capacity of 7.8 TWh[15], which is equivalent to three years’ normal river inflow, and can store water for a long period to meet high electricity demand during the heating season in winter or support electricity supply in a dry year [25]. In addition, other hydropower plants with small reservoirs offer short-term flexibility, and can be operated to provide both baseload and peak load due to their ability to be shut down and started up at short notice. Overall, these reservoir storages help to smooth out production over days, weeks, months or between years.

Reservoirs also make it possible to manage output to maximise income through both export and import power to or from neighbouring countries when there is a price difference. Electricity is exchanged with Sweden, Denmark, and Finland through an integrated market called Nord Pool, which is in turn connected to the wider European market through interconnectors to the UK, Netherlands, Germany, the Baltic states, Poland, and Russia

More than 75% of Norway’s renewable generation is dispatchable [26], which ensures the electricity system operates with high levels of reliability and security.

Electricity systems with very high VRE share