DOI: http://dx.doi.org/10.7488/era/4346

Executive summary

Aims

This research is a rapid review, presenting and examining evidence relating to climate change and digital connectivity such as:

- whether investment in digital connectivity can support reductions of greenhouse gas (GHG) emissions and, if so, how

- examples of relevant policies and impacts

- the best options for assessing emissions from digital connectivity and services in Scotland

- key evidence gaps in these areas.

The review was undertaken between October and the middle of December 2023 and was focused on and bounded by specific criteria set out by the Scottish Government and ClimateXChange steering group. The study team were asked to only include information and projects that were current and operating, not theoretical. Search terms were selected and agreed with the steering group.

We used a methodology known as “claim, argument, evidence” to assess whether claims made within certain arguments were true or false. We classified evidence as having low, moderate or good confidence levels, based on its volume and quality, and the level of agreement in the literature reviewed.

Findings

We have found mixed evidence of the decarbonisation impact of digital connectivity and whether it contributes to adaptation and a just transition. Our main findings on basis of the literature reviewed are:

- The Information Communications Technology (ICT) sector is a source of GHG emissions. The sector’s energy consumption and generation of electronic waste (e-waste) generates GHG emissions directly. This is despite the possibility that it can reduce emissions indirectly by increasing efficiency and through behaviour changes like reduced travel due to remote meetings. Studies point out a need for a holistic approach in calculating GHG emissions of the ICT sector, to fully account for indirect emissions and emissions from end-of-life.

- ICT technology and digitalisation reduce GHG emissions in other industries. Heavy industry and the energy sector would benefit the most from digitalisation. To achieve this, there would need to be widespread high-speed internet coverage, which would likely generate further GHG emissions. On their own, digital connectivity infrastructures do not support emissions reduction. They provide a mechanism to support decarbonisation of other sectors.

- The GHG emissions associated with e-waste are of growing concern internationally. Even though ICT use could help reduce GHG emissions in other sectors, it is uncertain whether this can outweigh the direct emissions of the ITC sector. It gives us only moderate confidence that the ICT sector can help reduce more emissions than are inherent in the manufacture, use and disposal of the equipment used.

- The indirect impact of ICT technologies can either lead to a net reduction in carbon emissions or to a net increase. The overall effects depend on context. Rebound effects can lead to increases in emissions. Policy and measurement do not usually account for these effects. Human behaviour plays a part in whether the indirect impacts on emissions are positive or negative. This means that it is not solely down to technology and therefore we are only moderately confident that the challenge of emissions reduction can solely be met by utilising digital technology.

- We are unable to say whether digital connectivity supports climate adaptation because of the small number of ex-post studies in this area. With regard to a just transition, digital connectivity and ICT can have either a positive or a negative effect, either addressing or exacerbating existing inequalities such as access to digital connectivity and skills. Studies repeat the need for strong policy in this area.

Within the literature reviewed as part of the study, we identified gaps in knowledge, including:

- Lack of evidence on whether investment in digital connectivity directly reduces GHG emissions, or contributes to a just transition and how.

- There are varying approaches to quantifying direct and indirect emissions of ICT and to comparing the GHG emissions of digital and non-digital practices and solutions.

- Climate adaptation in relation to ICT is either an afterthought or future looking, with few real-world examples.

- Case studies of digital technologies saving money, power or water in municipalities focused on the GHG emissions reduced or averted, with no acknowledgment of rebound effects, which literature states is important.

- The GHG emissions of data collection and use necessary to digitalisation are opaque and limited to specific studies on data centres.

- Lack of evidence of policy to address GHG emissions of e-waste or the embedded emissions from extraction of raw materials and production of ICT equipment.

- Lack of best practice for measuring, monitoring and assessing the GHG footprint of electronic communications services.

Glossary

|

Term |

Description |

|---|---|

|

Backhaul |

The set of copper, fibre or wireless links that connect the core (or backbone) telecommunications networks with smaller subnetworks, such as private internet networks. |

|

Co-located or edge data centres |

In co-location, an organisation rents space within a data centre owned by others and located off premises. |

|

Data Over Cable Service Interface Specification (DOCSIS) |

DOCSIS delivers high-speed network or internet access through cable television. |

|

Digital economy |

The economic activities that emerge from connecting individuals, businesses, devices, data and operations through computers and connectivity. |

|

Digital productivity paradox or Solow computer paradox |

The observation that as more investment is made in information technology, worker productivity may go down instead of up (Dreyfuss, et al., n.d.). |

|

Direct emissions |

Emissions from energy consumption and generation of electronic waste (e-waste). |

|

Direct Subscriber Line (DSL) |

DSL technologies deliver high-speed network or internet access over voice line. |

|

Electronic waste, e-waste |

Waste from end of life, broken or obsolete ICT equipment. |

|

Embedded or embodied carbon |

The carbon footprint, i.e. the GHG emissions, from producing and manufacturing a product or service. |

|

Energy Management System, ISO 50001 |

An international standard organisation system for managing energy use. |

|

Global warming potential, GWP |

Relative potency, molecule for molecule, of a greenhouse gas, taking account of how long it remains active in the atmosphere. Global warming potentials (GWPs) are calculated over 100 years. Carbon dioxide is the gas of reference, with a 100-year GWP of 1 (Eurostat, n.d.). |

|

Hyperscale data centre |

A hyperscale data centre is a large offsite facility housing servers which exceeds 5,000 servers and 10,000 square feet. |

|

Information and Communications Technology (ICT) sector |

The ICT sector combines manufacturing and services industries whose products primarily fulfil or enable the function of information processing and communication by electronic means, including transmission and display (OECD Library, 2023). |

|

Indirect emissions |

Emissions not directly related to ICT but influenced by its use, e.g. decreased or increased emissions from working from home. |

|

Internal datacentre |

An organisation uses in-house servers that are located onsite. |

|

Internet of Things (IoT) |

Connected devices pooling data, often in real time, for decision-making. |

|

Just Transition Score (JTS) |

Measures the carbon efficiency of social progress of each country, based on the ratio of consumption-based CO2 emissions per capita to the Social Progress Index (Social Progress Imperative, 2022). |

|

Life Cycle Assessment (LCA) |

A technique to systematically analyse the potential environmental impacts of products or services over their entire lifecycle, including on human health, land use, resources and acid rain formation. |

|

Power usage effectiveness (PUE) |

The metric used to determine the energy efficiency of a data centre. A PUE value of 1.0 indicates that all energy consumed by a data centre is used to power computing devices. As some wastage is inevitable, the most efficient data centres in the world achieve a PUE of 1.2 (Lavi, 2022). |

|

Rebound effect |

Increase in energy demand due to efficiency savings, such as cost savings, that might be used for other energy consumption purposes (Lin & Huang, 2023). |

|

Workload |

Amount of computing resources and time it takes to complete a task or generate an outcome. Any application or program running on a computer can be considered a workload (HP Enterprise, n.d.). |

Introduction

Need for this research

The extent to which the development and deployment of digital and data solutions supports the reduction of a country’s greenhouse gas footprint, assists in adaptation, and contributes to a just transition is unclear. Digital technologies have become an integral part of our lives, but they also have an environmental impact, including the production of greenhouse gas emissions (GHG) during their manufacturing, use and disposal.

In recent years, over £1 billion has been invested in programmes to enhance digital connectivity in Scotland, for a variety of anticipated outcomes relating to regional equity and opportunity. These include Digital Scotland Superfast Broadband (DSSB), Reaching 100% (R100), Scottish 4G Infill (S4GI), and the Scotland 5G Centre, with a regional network of 5G Innovation Hubs to facilitate widespread deployment of 5G.

Digital connectivity, and increasing access to it, is the focus of many Scottish Government policies. The Digital Strategy, ‘A changing nation: how Scotland will thrive in a digital world,’ is the policy backbone, setting out actions on: broadband and connectivity; data and statistics; digital inclusion and ethics; digital, data and technology profession, skills and capability; Transforming public services; and the Technology Assurance Framework. Enhancing Scotland’s digital infrastructure, both nationally and internationally, has also been a stated priority in successive Programmes for Government and the 10-year National Strategy for Economic Transformation (NSET) published in 2022. There is a lack of current evidence on the extent of the potential contribution of digital connectivity to Scotland’s climate change goals, not least of achieving net zero by 2045.

Project aim

The aim of the project is to examine recent research on climate change and digital connectivity to answer the following questions:

- To what extent is there evidence that investment in digital connectivity can support emissions reduction, climate adaptation and a just transition?

- If so, what are the key mechanisms by which this could occur (for example, reduction in travel, investment in green data centres or other mechanisms suggested in the evidence)?

- What are key examples of existing policies (in Scotland, such as in Local Authorities, the UK and/or international examples from comparable countries) designed to support emission reductions, adaptation, and/ or just transition through digital connectivity? Is there any evidence for the impact of such policies?

- What are the different options suggested within the literature for Scotland to provide a baseline assessment of, and monitor carbon emissions from digital infrastructure, technologies, and associated activities?

- What are the other key gaps in existing knowledge where further research is required to support digital connectivity and Scotland’s climate change goals?

These questions are answered in Sections 5, 6, 7, 8 and 9. By better understanding the mechanisms in which digital connectivity supports Scotland reaching net zero, policy makers will know how to influence what they want to occur.

Key terms used throughout the report are explained in the Glossary in Section 2.

Components of the digital landscape covered by this research

The focus of the research is digital connectivity. This can encompass a wide range of products and services. Figure 1 sets out the boundaries of the research undertaken to inform this paper, including:

- infrastructure such as fixed broadband, mobile connectivity and data centres

- application, use and behaviours such as artificial intelligence and the Internet of Things, data driven products and services, and practices such as home working

- the list of countries with applicable learning for Scotland.

Figure 1 – The landscape of digital connectivity defined as within scope of this research.

Approach to the research

This section provides an overview of the research approach. Our full methodology is outlined in Appendix 1.

Methodology for collecting evidence

Frazer-Nash Consultancy (Frazer-Nash) was tasked with completing this research for ClimateXChange (CxC) on behalf of the Scottish Government Digital Connectivity Division. A steering group was set up consisting of representatives from Scottish Government, CxC and Frazer-Nash.

We followed an approach based on the Double Diamond approach of Discovery and Define[1], including literature gathering, revising and providing initial conclusions, and further developing conclusions before developing the report. We socialised the initial and final conclusions with the steering group. Keywords for the literature search were also agreed with the steering group. The literature reviewed was identified through google and google scholar searches. The review was focused on and limited by specific criteria, such as the non-inclusion of theoretical studies around “what is possible”, with an emphasis on current and recent experience.

Methodology for policy review

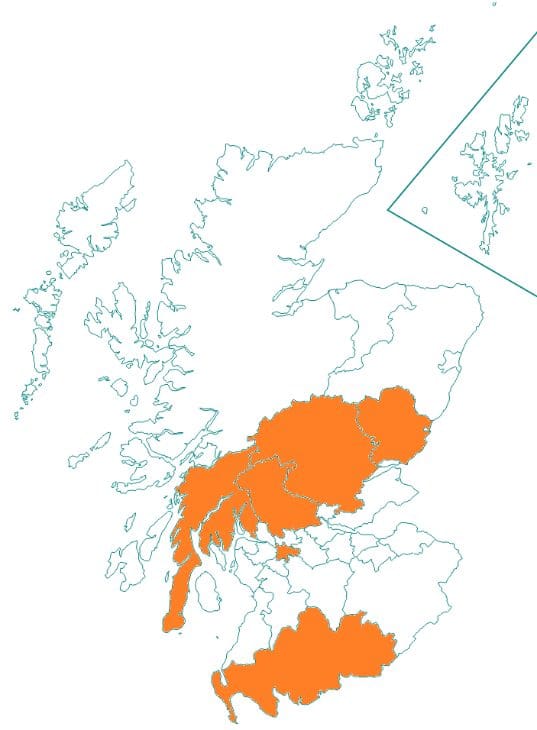

One of our research questions requests a review of policies which were designed to support emission reductions, adaptation or just transition through digital connectivity. To determine the geographic scope of the research, we chose countries analogous to Scotland facing similar digital connectivity challenges, that is, large landmasses with areas of low population density, and a number of isolated and rural remote communities. This list was agreed with the steering group and consists of: Finland, Wales, Portugal, Norway, Sweden, Estonia, Canada (Ontario), New Zealand, Denmark, and Iceland.

We use a star key (Table 3) to rate the extent that digital connectivity and emissions reduction are linked within a country’s policy.

Section 7 sets out the policies we found and reviewed.

How we have presented our findings

By following this methodology, we came up with a series of statements based on the findings from our research. These are presented in Section 5 and 6 with a structure as follows:

- Claim: a conclusion formatted in bold and accompanied by a statement of confidence in our conclusion.

- Argument: concise statements explaining how we arrived at the conclusion.

- Evidence: synthesis of literature in support of our argument.

We have provided a confidence level based on the extent of agreement in the literature and the robustness of evidence. We follow a methodology similar to the one developed by the Intergovernmental Panel on Climate Change for the fifth assessment report and used for the sixth for the consistent treatment of uncertainties.

Figure 2 sets out what constitutes low, moderate, and good confidence in our claims.

Low agreement is where sources do not agree.

Medium agreement is where sources make broadly similar conclusions but the data or evidence they use to support their conclusions are very different.

High agreement is where sources independently make similar conclusions and underlying data are similar despite being independent.

Limited evidence is some evidence available but largely anecdotal and not from recognised peer reviewed sources. Availability of data was low.

Medium evidence is information from peer reviewed sources or official sources.

Robust evidence is a greater volume of information from peer reviewed sources and official sources.

The combination of low agreement and limited evidence provides the lowest level of confidence and the combination of high agreement and robust evidence provides a good level of confidence, with combinations in-between generating moderate confidence.

Our definitions for “limited”, “medium” and “robust” evidence are described in Appendix 1: Detailed Methodology & Approach to the Research. This means that when we say we have “good confidence” in a finding, we are content that there is medium to high agreement in the literature and medium to robust evidence provided for that claim.

Figure 2 – How extent of literature agreement and evidence robustness combines into our stated confidence level.

Investment in digital connectivity and emissions reduction

Digital connectivity, technologies and GHG emissions

We have good confidence in the evidence that, taken on its own, digital connectivity and digital technologies are sources of GHG emissions.

Digital connectivity enables a range of ICT applications. The underlying infrastructure that makes it all work often gives rise to GHG emissions. It depends on the structure of the primary energy and electricity generation sectors of the countries where ICT goods are produced and used, as well as the materials used, such as plastic. These emissions arise across communication equipment such as fixed and mobile broadband, datacentres, cables, and the computers or devices themselves.

The ICT sector is responsible for around 3% to 4% of global greenhouse gas emissions (UNEP, 2021). In Scotland, using domestic output and supply and the environmental input-output model greenhouse gas effects data, the sector contributes around 2% of direct and indirect emissions of carbon dioxide equivalent[2]. It is also true that regions and countries with higher levels of digital economy development have higher GHG emissions (Wang, et al., 2023). Between 1995 and 2015, GHG emissions of ICT manufacturing have doubled and demand for materials to develop more ICT equipment has quadrupled in the same time period (Itten, et al., 2020).

Besides the high-energy consumption of ICT and electronic equipment, many energy-intensive infrastructures such as backhaul and data centres need to be built to achieve digital connectivity (Lin & Huang, 2023). This means that GHG emissions will increase as a country or region digitalises, up to a certain point (explored further in section 5.1.2). On their own, digital connectivity infrastructures do not support emissions reduction. They provide a mechanism to support decarbonisation of other sectors.

Digital connectivity, emissions reduction and other economic sectors

We have good confidence in the evidence that digital connectivity can only support emissions reduction when paired with other economic sectors.

Digital connectivity is hailed as an enabler for decarbonisation. Despite being a source of GHG emissions themselves, they enable other sectors to digitise in ways that improve productivity and efficiency. The mechanisms by which this is achieved are explored more in Section 6. Essentially, ICT products and services allow traditional industry to change their methodologies to curb GHG emissions (Wang, et al., 2023). Many policymakers hope that the reduction in GHG emissions achieved by these sectors will outweigh the ICT sector’s emissions, as suggested by the European Commission, which states: “If properly governed, digital technologies can help create a climate neutral, resource-efficient economy and society, cutting the use of energy and resources in key economic sectors and becoming more resource-efficient themselves. When implemented under the right conditions, digital solutions have demonstrated significant reduction in greenhouse gas emissions, increased resource efficiency and improved environmental monitoring.” (European Commission, 2022)

Many policies are reliant upon a viewpoint that, on balance, digital innovation to reduce GHG emissions will outweigh the emissions cost of producing and maintaining the necessary ICT networks and components. It is less common for papers to acknowledge there is an initial increase in GHG emissions (particularly from energy use) at the onset of digitalisation. Nor are there many papers discussing the point at which digitalisation starts to reduce emissions.

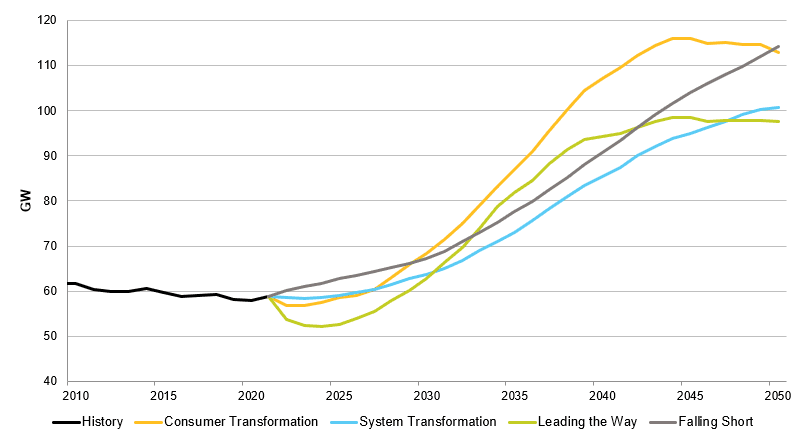

Lin &Huag is another paper that does address this issue (Lin & Huang, 2023). They state that with increased digitalisation, the resulting increased digital connectivity meant that an energy saving effect could be scaled up across the economy. This marginal energy saving effect exceeds energy consumption of the system – this could be seen as the point at which the GHG savings which result from efficiencies outweigh the GHG emissions from the energy use, production of devices and so on involved in digitalisation. Lin and Huang refer to this point as ‘digitalisation level 0.43’ (Lin & Huang, 2023). The digitalisation level indicator used in the paper is based on data on digital infrastructure, such as internet access and bandwidth, digital application, e.g. fixed and mobile subscription and digital skills and on aggregate ranges from 0 to 100%, using a weighted average for the component elements of the indicator. The paper stipulates that most developed countries have passed the 0.43 point, and it is reasonable to assume that this is the case for Scotland. The assumption of the inverted U-shaped relationship is well tested in the paper, see image in Figure 4. However, the slope of the downward curve is not specified and therefore the applicability of the analysis to Scotland is uncertain, however it is likely to depend on other factors such as the structure of the economy. (Lin & Huang, 2023) make no comment on obsolescence or upgrades to physical equipment.

Figure 4 – Country-level energy intensity against digitalisation; adapted from (Lin & Huang, 2023).

Paired with industrial sectors, there is therefore good evidence that digital connectivity supports emission reductions.

Indirect impacts from ICT use on GHG emissions

We have good confidence in the evidence that indirect impacts from ICT use can be both positive and negative for GHG emissions.

ICT can have both increasing and decreasing effects on GHG emissions. These can be direct or indirect. Direct impacts include energy consumption while the device is in use. Indirect impacts include secondary benefits such as more people being able to work from home and associated reduction in commuting emissions. While digital connectivity can reduce transport through, for example, hosting virtual meetings, some studies postulate that it could also increase emissions from transport by creating the desire to travel to places seen on the internet (Bieser and Hilty, 2018; Hilty and Bieser, 2017; Wang, et al, 2023). Many studies which look at quantifying both, the direct and indirect effects of ICT use, often conclude that the indirect effects are favourable (i.e., reducing GHG emissions) and far outweigh direct effects of energy use. However, these studies often neglect factors such as stimulating transport demand, rebound effects, behaviour changes of humans using these systems, or the embedded carbon of the product or service (Itten, et al., 2020).

The CxC study on emissions impact of home working in Scotland found a small reduction in commuting and office emissions and an increase in home emissions. However, how these changes in emissions balance for each individual defines the net emissions impact from homeworking (Riley, et al., 2021).

Therefore, we conclude from the literature reviewed, that the evidence remains divided in which is more significant: increasing or decreasing effects on GHG emissions.

Emissions reduction and digital technologies that rely on connectivity

We have good confidence in the evidence that the challenge of emissions reduction cannot be met without digital technologies that rely on connectivity.

A great number of the studies and policies we read stated strongly that the challenge of emissions reduction and climate adaptation will not be met without the intervention or use of digital technology and tools (including Royal Society, 2020; Exponential Roadmap Initiative, 2023). The three technologies most often hailed as transformative to all sectors of the economy are 5G, the Internet of Things (IoT, connected devices pooling data often in real time for decision-making) and artificial intelligence (AI, computer-based machine learning).

Many papers assert that digital technology has the potential to assist the transition to a low carbon world, enabling global emission reductions while limiting the emissions created by ICT use (Royal Society, 2020). Some claim that if the currently available digital solutions were used at scale, there would be the potential to reduce GHG emissions in the three highest-emitting global sectors (energy, materials, and mobility) by 20% by 2050 (World Economic Forum, 2022). There was no concrete evidence in these papers that connectivity would enable these goals to be met, only claims.

Sectors that will benefit the most from digital connectivity

We have good confidence in the evidence that suggests that the sectors that will most benefit from digital connectivity are industrial in nature and will vary from country to country.

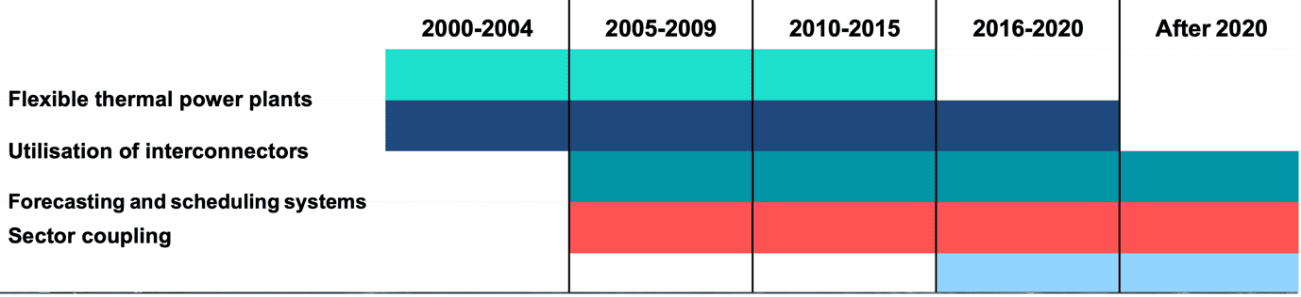

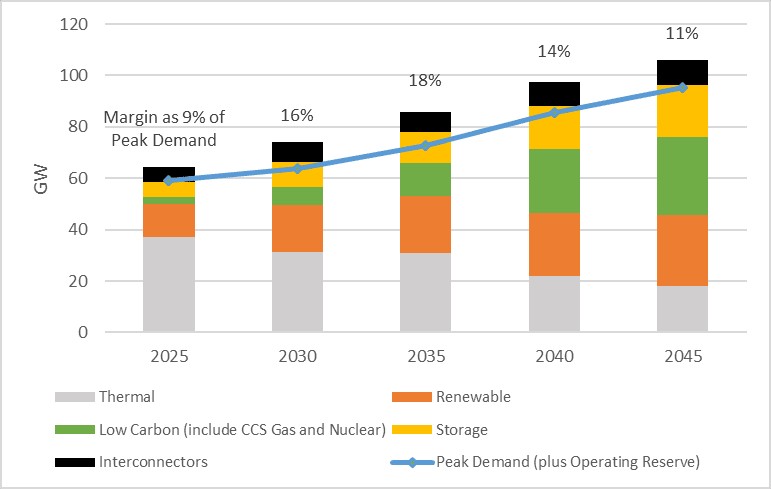

The sources above state the energy sector would benefit the most from digital solutions. In Scotland, the energy sector is the fourth highest emitter at 4.9 million tonnes of CO2e in 2021 (Scottish Government, 2021). With regards to electricity in particular, the complexity and scale of integrating more renewable energy generation and increasing the distribution capacity of the electricity grid will not be possible without digital technologies (Energy Systems Catapult, 2023), especially with increasing requirements for data sharing and more effective system planning and operation. Renewable generation is intermittent and requires active grid management. Digital technologies can help balance the supply side (electricity producers) and the demand side (consumers) management for a more agile, stable and reliable electricity grid for industrial, commercial and household users.

The industry sector is globally responsible for 37% of total final energy consumption and about 20% of GHG emissions. In Scotland, industrial processes and business account for 20% of CO2e in 2021.

As described in 5.1.4, digital technologies will be important to manage the supply and demand of large industrial energy users in a system with diverse sources and feedstock (European Commission, 2022).

The effective use of these digital technologies relies on connectivity. Without it, none of the claims explored in literature can come to fruition.

The emissions intensity of digital connectivity

We have moderate confidence in the evidence that the lowest emissions form of digital connectivity is currently fibre.

One study has found that fibre is the most energy efficient technology for broadband access networks, compared with the family of Direct Subscriber Line (DSL) technologies delivering network access through voice lines and Data Over Cable Service Interface Specification (DOCSIS) which delivers network access through cable television (European Commission, 2020). Studies brought together by Europacable also demonstrated that fibre is the most energy efficient technology for internet access compared to microwave, millimetre wave, copper, satellite, and laser (Europacable, 2022). This is because there are fewer intermediate devices and amplifiers, and glass fibre is largely passive and requires little energy to function.

Although 5G networks are touted to be more energy efficient than 4G networks, the overall energy and emissions impacts are still uncertain. 5G antennas use three times as much energy as a 4G antennae, and a higher network density will be required (International Energy Agency, 2023). Literature on the energy use of 5G is found to be dominated by small-scale, single technology assessments. Embedded energy use and indirect energy use effects are largely overlooked (Williams, et al., 2022).

Satellite broadband is a less disruptive approach to connect rural areas to the internet, requiring less work on land to lay cables, however the GHG emissions of Low Earth Orbit (LEO) satellites are only recently being explored. An October 2023 study estimates worst-case emissions to be 31-91 times higher than equivalent terrestrial mobile broadband (Osoro, et al., 2023). It is unclear whether the terrestrial mobile broadband used in this comparison is sufficiently representative of a rural broadband connection or fixed broadband.

The World Bank identified a strong statistical connection between the capacity of the network (the number of users and the amount of data they require) and the level of GHG emissions (World Bank, 2022). Fibre has a high data capacity, but is only one component of a network. There are other critical parts of the network infrastructure such as data centres which drive this trend.

The most efficient data centres and emissions reduction

We have moderate confidence in the evidence that hyperscale and co-located data centres are the most efficient and offer a high potential for reducing emissions.

Data centres and data transmission networks account for approximately 1-1.5% of global electricity use, making them responsible for 1% of energy-related GHG emissions (IEA, 2023). Rapid growth in demand at large data centres has resulted in a substantial increase in energy use in this sector, growing 20-40% annually over the past several years (IEA, 2023). As a result of this, the International Energy Agency (IEA) has given data centres the “More Efforts Needed” rating, which means that data centres need to do more to align to the IEA’s Net zero by 2050 Scenario. Progress is assessed at the global level against the IEA’s net zero by 2050 Scenario Trajectory for 2030 (IEA, n.d.), and recommendations are provided on how they can get “on track” with this pathway. Recent trends on reducing the environmental impacts of data centres have generally been in the right direction to match this trajectory; however, without acceleration it will fall short (IEA, n.d.).

The carbon footprint of a data centre is affected by three factors:

- electricity consumption

- water consumption

- lifetime of the equipment.

When analysing these factors, it can be seen in Table 1 that hyperscale and co-located data centres are far more efficient (including accounting for water consumption) than internal data centres. This is driven by better energy utilisation, more efficient cooling systems and increased workloads per server (Lavi, 2022). As a result, they are less carbon intensive per tonne of GHG emissions per workload than internal data centres.

Table 1 – Impacts of hyperscale, colocation and internal data centres. Adapted from Lavi, 2022.

|

|

Internal |

Colocation |

Hyperscale |

|---|---|---|---|

|

Energy use (million MWh) |

26.90 |

22.40 |

22.85 |

|

Computing workloads (million) |

16 |

41 |

76 |

|

Water intensity (M3MWh-1) |

7.20 |

7.00 |

7.00 |

|

Carbon intensity (Ton CO2-eq MWh-1) |

0.45 |

0.42 |

0.44 |

|

Water intensity (m3/ workload) |

12.15 |

3.85 |

2.10 |

|

Carbon intensity (Ton CO2-eq/ workload) |

0.75 |

0.25 |

0.15 |

With Scotland’s electricity maintaining a grid intensity of below 50 grams of CO2e per kilowatt hour delivered across 2017-2020 (Scottish Government, 2023), as opposed to the UK average of 149 grams of CO2e per kilowatt hour delivered in 2023 (National Grid, 2023), the emissions intensity of datacentres in Scotland is likely to be significantly lower.

Summary

Investment in digital connectivity can support emission reductions for those primarily industrial sectors which benefit from efficiency. ICT reliant on digital connectivity is supposed to help meet challenges of emission reduction although there is a lack of evidence for these claims.

Digital technology is a source of emissions in and of itself which tends to be overlooked.

As a result of these, we cannot say for certain whether the indirect effects of digitalisation (e.g., saved emissions from home working, see Section 5.1.3) will reduce overall emissions.

Climate adaptation, just transition and investment in digital connectivity

This section sets out the evidence we have been able to find that meets our criteria. Although just transition and adaptation are important policy areas, the steering group wished to focus primarily on Net zero targets and emissions reduction with this research. The Steering Group also emphasised the need to only include information and projects that were current and operating, not theoretical.

The resulting research has emphasised how these concepts are new and emerging. As novel as the concepts such as just transition and adaptation are, the evidence base is being created. As the situation progresses, more and more evidence will be developed to revise the assertions below.

Digital connectivity and adaptation strategies

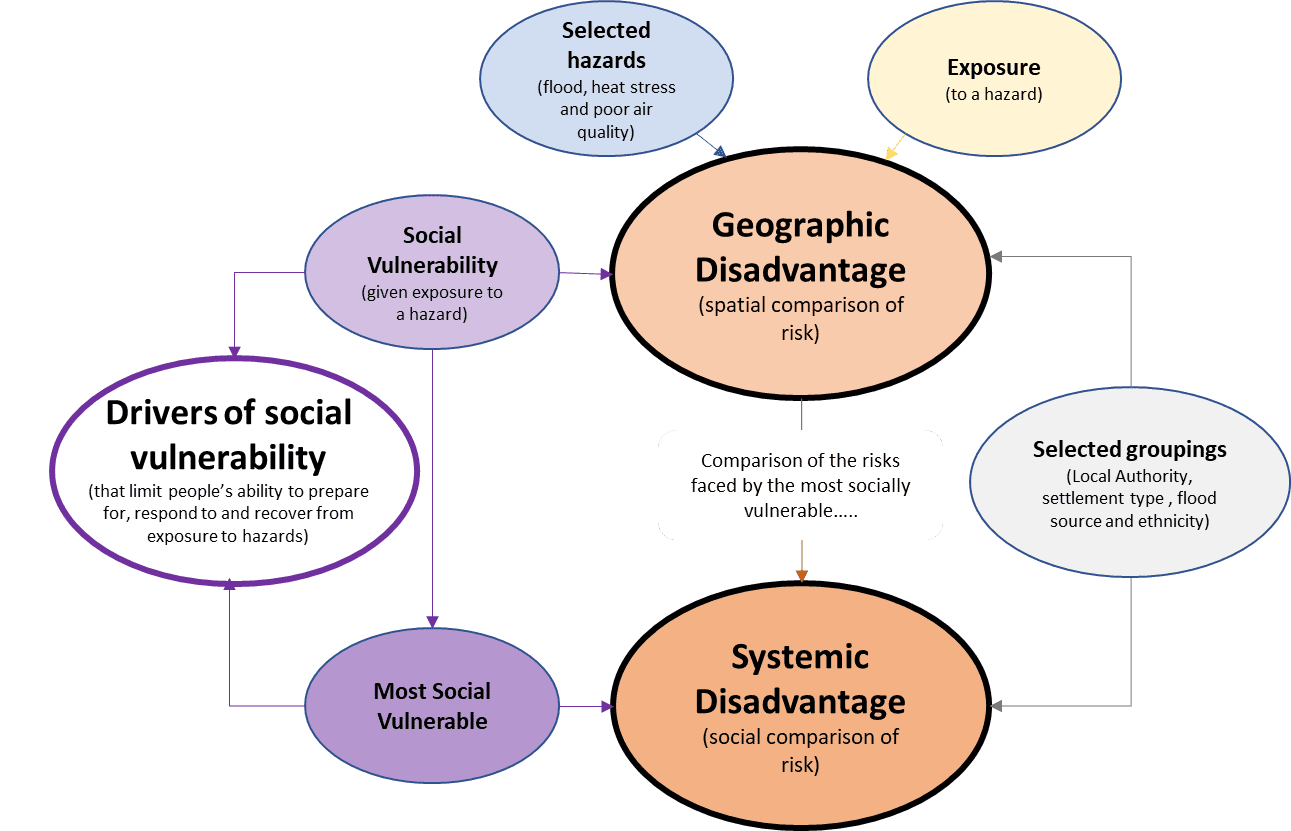

With the evidence we have been able to find that meets our criteria, we have low confidence in the evidence that digital technologies, which rely on connectivity, support climate adaptation strategies.

ICT technology is an integral component of many proposed mitigation measures (Dwivedi, et al., 2022), but less so for adaptation. Mitigation is reducing and stabilising levels of GHG emissions; adaptation is adapting to life in a changing climate. It is considered by many that digital connectivity and the ability to communicate and share data will be important for adaptation, especially in rural communities.

The example we have been able to find include the European Commission Farmers Measure Water project, where one farmer described how decisions need to be made quickly: “We need fast internet in rural areas because a lot of farmers and water authorities have to make decisions on an hourly basis. If we take a measurement and only see the results in a week’s time, it is too late: the problem has already occurred. If you have fast internet, you have direct access to your data and can decide on the spot what to do” (European Commission, 2022).

Digital technologies can also support climate-resilient agriculture by helping farmers assess weather forecasts and mitigate impacts on crop yields and productivity (United Nations Development Programme, 2023).

In terms of what the ICT sector itself is doing to adapt to climate change, in 2018 TechUK submitted a report to the Department for Environment, Food and Rural Affairs (Defra) on behalf of the ICT sector outlining how the sector intends to adapt to climate change. Within it, they state that ICT infrastructure including connectivity has unique characteristics that make it more resilient (TechUK, 2018). These include:

- Asset life is relatively short. So more resilient assets can be deployed as part of the normal replacement cycle.

- There is built in redundancy in ICT infrastructures so that if same proportion of ICT assets is damaged or affected by climatic events, there are backups.

- Technology development is fast particularly around threats.

The first two of these are in direct conflict with reducing the direct GHG emissions of ICT and digital connectivity delivery. Programmes that mandate less redundancy or longer asset life may affect the ICT industry’s ability to adapt to climate change. The final point reinforces the ICT sector’s claim that it will innovate out of problems, without evidence to support it.

Digital connectivity and a just transition

With the evidence we have been able to find that meets our criteria, there is moderate evidence that digital connectivity supports a just transition.

There is debate in the literature over whether digital connectivity supports a just transition. Views are largely that it may help when accompanied by strong policy. One study shows that the Just Transition Score may increase as digitalisation increases (Wang, et al., 2022), but this could be a correlation rather than indicating causation. The mechanisms are also little explored: for example, one paper sets out that the digital economy indirectly improves just transition by increasing the level of human capital and financial development (Wang, et al., 2022). There is no further investigation into how this takes place.

There are a few points of information related to how digital connectivity relates to just transition:

- People with low and medium income are more vulnerable to the impacts and costs of economic transitions. Transitions may include job automation, increasing need for access to digital solutions and digital public services, higher energy and food prices, or transport poverty (European Commission, 2022).

- Some articles link which digital solutions can be justice and equity enablers. Examples include

- smart energy management and decentralised and distributed energy production and sale (United Nations Development Programme, 2023)

- an easy-to-use and reliable public transport system that improves mobility for all (United Nations Development Programme, 2023).

This indicates that digitalisation may enhance a just transition.

- Collecting data and use of data is highlighted as important for justice and social good (Friends of Europe, 2021). Many smart solutions require a level of monitoring to maintain the efficiency of the service. Regulation, oversight and controls on appropriate data collection and use will be key. This indicates that policy implemented through digital solutions may become increasingly important in relation to a just transition.

- Across many policies, a just transition is also linked to skills development, with the Climate Change Committee (2023) stating digital skills as a fundamental enabler of net zero. The Welsh Government state the need to “prevent existing labour market inequalities being carried through into the new net zero and digital economies” (Welsh Government, 2022), recognising that employers are actively seeking employees with digital skills.

Summary

The evidence base related to digital connectivity and adaptation in relation to concrete real-world examples is very limited among the literature we have reviewed.

There is no direct evidence to date that investment in digital connectivity supports a just transition, but there are many suggestions for mechanisms by which it might influence a just transition. One of these mechanisms is skills development.

Key mechanisms by which digital connectivity influences emissions reduction

Digital connectivity, primary needs for travel and GHG emissions

We have moderate confidence in the evidence that digital connectivity can reduce primary needs for travel, although we have low confidence to whether this reduces GHG emissions in total.

The assumption that digital can replace physical goods or services completely and therefore avert emissions underpins a great deal of policies supporting digitalisation. It is true digitalisation can substitute certain products or GHG generating activities, such as an e-reader capable of displaying hundreds of books or videoconferencing and telework replacing physical travel. Methodologies to measure the true GHG emissions savings of these substitutes are not rigorous or consistent (Hook, et al., 2020). At the same time, demand for travel is still growing (Itten, et al., 2020; Statista, 2023).

Differences in methodology, scope and assumptions make it difficult to estimate average energy savings of working from home versus working in the office. Rebound effects and home energy use is often overlooked, and where they are included, studies find smaller savings (Harvard Business Review, 2022). Rebound effects include increased non-work travel and more short trips. For example, Harvard Business Review found that a decrease in vehicle miles driven is accompanied by a 26% increase in the number of trips taken (Harvard Business Review, 2022). Trips which would have been taken anyway, such as taking children to school, are also not included.

In the report “Emissions impact of home working in Scotland” concludes that working from home leads to a reduction in commuting and office emissions and an increase in home emissions. How these changes in emission balance out for each individual defines whether their net impact from home working will be positive or negative. The authors state that across their scenarios, the overall impact on emissions will be small (Riley, et al., 2021).

Due to the ambiguities in methodologies, the actual or potential GHG emission reductions of teleworking remain uncertain. Economy-wide savings are likely to be modest (Riley, et al., 2021), and in many circumstances could be negative or non-existent (Hook, et al., 2020).

Public sector digital technology use

We have good confidence in the evidence that the public sector is using technology to solve problems linked to sustainability – but the evidence is not accompanied by reports on the effects of technology use on GHG emissions.

The mechanism of reducing GHG emissions by public sector authorities using digital technology is mainly around energy efficiency. Many documents include a wealth of examples of cities using technology to save energy (European Commission, 2022) – but the GHG emissions associated with implementation or life cycle of this equipment have not been considered.

Main source of emissions from digital connectivity and associated ICT

We have good confidence in the evidence that the largest proportion of emissions from digital connectivity and associated ICT equipment comes from waste management after use.

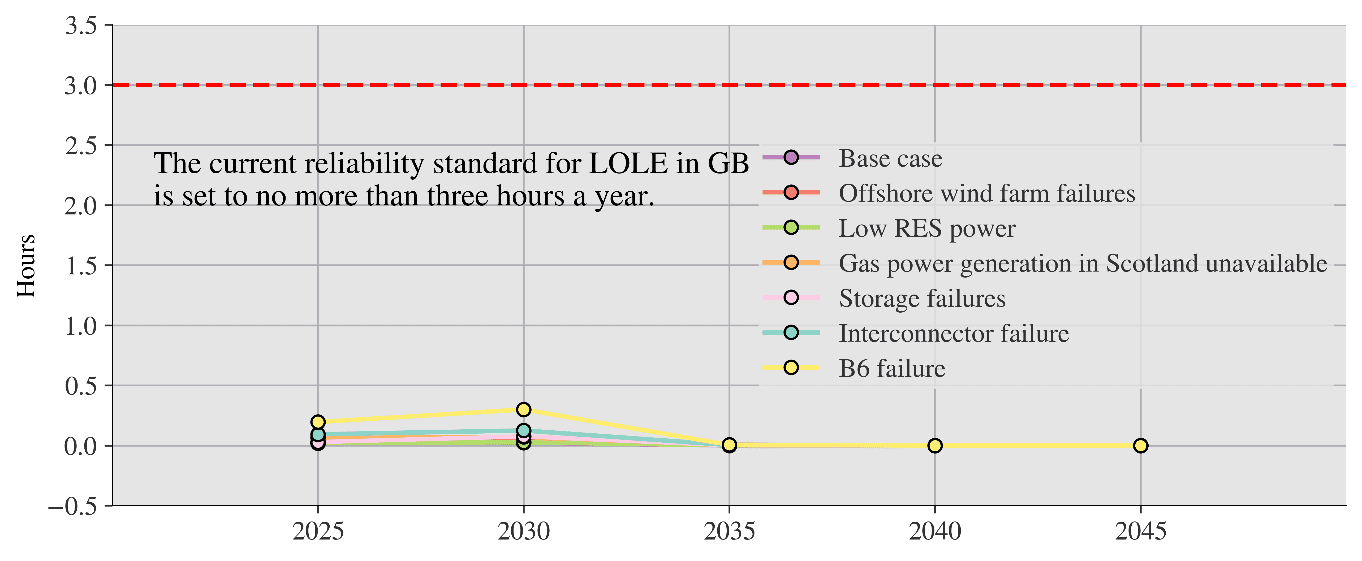

The ICT sector tends to focus on energy use of their products as the largest influence on the carbon footprint. Therefore, there are calls for energy sources to be decarbonised (Ericsson, n.d.). Independent academic studies are more likely to conclude that the carbon footprint or life cycle emissions of a digital product is dominated by electronic waste or e-waste (Itten, et al., 2020 and Dwivedi, et al., 2022). Figure 5 shows the result of a study into video streaming from device purchase, which identifies that 78% of the GHG emissions are from e-waste (Itten, et al., 2020). This illustrates our claim that the largest proportion of emissions from the use of devices comes from waste management after use (please note, extraction of materials and production was not included in this study, which focused on impacts from consumer behaviour).

Figure 5 – Proportion of GHG emissions from the use case of streaming videos (Itten, et al., 2020).

In its 2020 report on e-waste, the International Telecommunication Union (ITU) estimates that 15 million tonnes of CO2e were averted by the recovery of iron, aluminium, and copper from processed e-waste (International Telecommunications Union, 2020). The ITU report also disclosed that less than 18% of all e-waste can be accounted for, meaning that almost 83% of e-waste is likely not properly disposed of. The sector’s emission reductions may be limited because of the uncertain fate of e-waste.

Human behaviour and digital connectivity

We have good confidence in the evidence that human behaviour plays a role in digital trends, rebound effects, and responsible use of digital connectivity.

Academic papers point out that whilst digital technologies are becoming more efficient individually, the higher demand for computing power, storage capacities, transmitted data and devices per person is systematically compensating for this progress (Aebischer & Hilty, 2015) (Hischier & Wager, 2014). This trend can be partially explained by rebound effects regarding time, volume, weight, and price (Itten, et al., 2020), but also human behaviour. Technology can act as a fashion or wealth statement, with the average person owning more and more connected devices such as smartphones and smart watches. These are often replaced with the latest model far sooner than is required on a technology replacement cycle (Itten, et al., 2020).

Future ICT sector energy consumption reduction

We have moderate confidence in assertions that the ICT sector will continue to innovate to reduce energy consumption.

Deployment of next generation low-power chips and more efficient connectivity technologies (5G and 6G, networks powered by artificial intelligence) is repeatably hailed as the way to reduce the overall footprint of ICT (European Commission, 2022).

Each switch to new standards or technologies requires a massive replacement of equipment. For example, 5G and 6G will require users to replace equipment, due to lack of backwards compatibility of existing smartphones, tablets, and computers. Also, as a growing fraction of products become smart or part of the Internet of Things (IoT), overall resource demand could decrease in theory. In practice, the opposite happens because software-controlled objects are also prone to software-induced obsolescence (Kern et al., 2018; NGI, 2020). While each new model is likely to be more energy efficient than the last, and while smaller smart IoT devices may not consume large amounts of energy in use, 85-95% of their lifecycle energy footprint is created in production. The sheer number and variety make them particularly susceptible to obsolescence once software or hardware support runs out (NGI, 2020).

The fast-evolving nature of digital technologies and the possible sharp increase in digitally enabled services is likely to reinforce the ICT sector’s growing emissions (European Commission, 2023). The European Commission has set out that unless digital technologies are made more energy-efficient, their widespread use will increase energy consumption.

Summary

The key mechanisms that ICT and digitalisation can reduce GHG emissions described by literature include replacing the need to travel, although there is evidence that these savings may not be as high as first thought. The largest source of emissions from ICT equipment is after use, as e-waste, something that changing standards and upgrading systems can increase. Human behaviour plays a role in the resulting emissions from ICT and digitalisation.

Key examples of digital connectivity policies

We studied international policies associated with digital connectivity and decarbonisation, adaptation and just transition in 10 countries, selected based on the methodology in Section 4, to gather important contextual information for Scotland. The degree to which each country links their digital goals and strategy has been given a score, with five representing explicit mention of the GHG or carbon impacts of increased digitalisation, and one representing no mention or linking of decarbonisation within the policy, see Appendix 1 for further detail on the scoring.

|

Country |

Score |

Key conclusions and data sources |

|

Finland |

★★★★ |

Finnish policy does connect increased digitalisation with helping the green transition, but there is no explicit mention of the carbon impact of increased digitalisation on the environment. Finnish Government, 2022 European Union Digital Skills and Jobs Platform, 2023 Ministry of Finance Finland, n.d. |

|

Portugal |

★★ |

Portugal says digitalisation will contribute to decarbonisation. Portugal Digital, 2020 Global Enabling Sustainability Initiative, 2020 |

|

Norway |

★★ |

Norwegian policy connects increased digitalisation with aiding the green transition. Norwegian Ministry of Foreign Affairs, n.d. Norway and European Union, n.d. |

|

Sweden |

★★★★ |

Swedish policy links the use of ICT to decarbonisation effects, as well as acknowledging decarbonisation, circularity, conscious choices, and the energy transition as drivers for a sustainable world. OECD, 2018 Regeringskansliet, 2010 |

|

Estonia |

★★★★★ |

Estonian policy contains a clear and explicit mention of the carbon effects of increased digital footprints, and provides a commitment to reduce the effects. European Union Digital Skills and Jobs Platform, 2023 |

|

Canada (Ontario) |

★ |

Canadian policy contains no mention of the carbon or environmental impact of increased digitalisation. Government of Canada, 2022. Ontario, n.d. |

|

New Zealand |

★ |

New Zealand policy does not explicitly mention the carbon or environmental impacts of increased digitalisation. Digital.Govt.NZ, n.d. Digital.Govt.NZ, 2022 |

|

Denmark |

★★★★ |

Danish policy takes a holistic approach to digitalisation and digital section emissions, with direct considerations for green ICT acquisition and support for the EU’s Green Public Procurement criteria. The Danish Government, 2022 Digitalserings Partnerskabet, 2021 Agency for Digital Government, n.d. |

|

Iceland |

★★★ |

Icelandic policy nods to sustainable procurement as a lever for green digitalisation, but provides no quantification. Nordic Council of Ministers, n.d. Government of Iceland, 2021 Stjornarrad islands, 2023. |

|

Wales |

★★★★ |

It is recognised that digitalisation will play a role in the transition to net zero in the Decarbonising Wales with digital technology website. Centre for Digital Public Services, 2022 |

Appendix 2: Summary of digital policies across 10 countries provides further detail on individual policies.

Decarbonisation impact of these policies

Policy measures to support emission reductions, adaptation or just transition

Few of the countries we studied for this research have set policy measures designed to support emission reductions, adaptation, or just transition in direct association with digital technologies.

No evidence of impact has been identified during this review. This does not prove a lack of progress or attention. There are other jurisdictions outside the scope of this research which may have evidence of policy impact. An example is the European Union Declaration on Digital Rights and Principles. This promotes digital products and services with a minimum negative impact on the environment and on society, as well as digital technologies that help fight climate change (European Commission, n.d.).

Sustainability considerations of using ICT and digital infrastructure

We have good confidence that European countries are starting to look at the sustainability considerations of using ICT and digital infrastructure.

The European Commission is leading the way in setting net zero or climate neutrality targets for certain elements of ICT infrastructure. In the “Fit for the Digital Age Strategy”, the Commission sets ambitious goals such as the climate neutrality of data centres in the EU by 2030 (European Commission, 2023). Measures to improve the circularity of digital devices and to reduce electronic waste include the Right to Repair Directive (European Commission, 2023) and the recently issued eco-design criteria for mobile phones and tablets (European Commission, 2023). These should have a corresponding positive impact on lifecycle emissions from digital technologies. Efforts are also ongoing to develop low-energy chips under the European Processor Initiative (European Processor Initiative, 2023).

The European Commission is starting to look at policy and governance around ICT direct and indirect emissions: “Until recently, the digital transition progressed with only limited sustainability considerations. To diminish adverse side effects and deliver its full potential for enabling environmental, social, and economic sustainability, the digital transition requires appropriate policy framing and governance” (European Commission, 2022).

“Digitalisation is an excellent lever to accelerate the transition towards a climate-neutral, circular, and more resilient economy. At the same time, we must put the appropriate policy framework in place to avoid adverse effects of digitalisation on the environment.” Svenja Schulze, Federal Minister for the Environment, Nature Conservation and Nuclear Safety of Germany (European Council, 2020).

Policy development programmes for datacentre best practice

We have good confidence that countries are starting to drive policy for data centre best practice.

In Estonia, the government has moved to the use of the Estonian Government Cloud (Riigipilv) for ‘Infrastructure, Platform and Software as a Service.’ Analysis of this pointed out that eliminating in-house servers and server rooms, instead relying on cloud services via data centres, offers the biggest potential for reducing emissions (Vihma, 2022). Data centres of the Estonian Government also use the ISO50001 energy management certification.

In Germany[3], the Government launched the Green IT initiative in 2008 to reduce the energy consumption and GHG emissions of its ICT operations. One objective set for the 2022 to 2027 phase of Green IT initiative includes that ‘main’ data centres (>100kW ICT load) owned by the government should meet the German Federal Government Blue Angel criteria for energy efficient data centres (Blume & Keith, 2023). From the start of the initiative, energy consumption has fallen by 49% from 649.65 GWh in 2008 to 334.54 GWh in 2021. This reduced consumption resulted in budgetary savings of €546 million (Blume & Keith, 2023).

In Denmark, the Agency for Digital Government examined which environmental requirements the public sector can include in tenders for data centres and concluded that the EU’s Green Public Procurement criteria is the most appropriate to use (Agency for Digital Government, n.d.).

In China, the Government has called for an average Power Usage Effectiveness of 1.25 in the east and 1.2 in the west of the country as part of its Eastern Data and Western Computing Project. Major cities now have maximum Power Usage Effectiveness requirements for new data centres, including Beijing (1.4), Shanghai (1.3) and Shenzhen (1.4) (IEA, 2023). Power Usage Effectiveness is the metric used to determine the energy efficiency of a data centre.

The private sector is also taking action to reduce the environmental impacts. In January 2021, date centre operators and industry association in Europe launched the Climate Neutral Data Centre Pact, pledging to make data centres climate-neutral by 2030 with intermediate (2025) targets for PUE and carbon-free energy (IEA, 2023).

Baseline assessments and monitoring

We have good confidence that there is no current framework for baseline assessment or monitoring of the environmental impact of increased digitalisation which also considers the indirect benefits and potential rebound effects.

There is a need to develop consistent metrics to measure the impact of technology on the environment (United Nations Environment Programme, 2021).

The European Commission identifies a need for a science-based assessment methodology on the ‘net environmental impact’ of increased digitalisation that consider both the benefits and the possible rebound effects (European Commission, 2022). The Commission has therefore launched dedicated research and innovation initiatives, saying that it will launch a project under Horizon Europe, to develop a methodology and common indicators for measuring the footprint of ICT (European Commission, 2023). In the UK, Building Digital UK also recognises this as a gap and will be reporting on environmental benefits of their interventions (Building Digital UK, 2023). Similarly, EU Member States are collaborating on the Toulouse call for a Green and Digital Transition in the EU. This looks to monitor the impact of digitalisation on the environment and contribute to the development of measurement tools (Presidence Francaise, 2022).

While the framework does not exist to quantify the full scope of direct and indirect effects, a number of standards exist for some elements.

Global standards to support carbon accounting in the ICT sector

There are global standards that can support carbon accounting (the method used to calculate a carbon footprint) in the ICT sector.

The main ones recognised and accepted by ICT bodies are:

- Greenhouse Gas Protocol ICT Sector Guidance. This builds on the internationally accepted GHG Protocol Product Life Cycle Accounting and Reporting Standard (GeSI and Carbon Trust, 2017).

- Recommendation ITU-T L.1470 (01/2020) (International Telecommunications Union, 2020).

- “Guidance for ICT companies setting science-based targets.” (Science Based Targets Initiative, 2022).

In summary

Our literature review has found no good examples of international experience of applying standard carbon accounting in the ICT sector, and this gap is recognised at the European Union level. Standards exist at the corporate or product level which could be adapted.

Conclusions

This work is the start of a process. As a rapid review, we were able to quickly identify information which fit our criteria, but there may be areas we have missed. Digital connectivity infrastructure and ICT are highly interconnected and overlapping with our behaviours and geography, and so this exercise has also highlighted we are having to pull together disparate pieces of information, research and case studies to try to come to conclusions. A key challenge is in understanding the “net” picture – there are disparate sources citing the means by which digital connectivity can impact on emissions, but it is not possible to combine this evidence to form a complete picture.

We were asked to research five key questions and found the following answers:

- To what extent is there evidence that investment in digital connectivity can support emissions reduction, climate adaptation and a just transition?

We have found mixed evidence of the decarbonisation impact, adaptation and just transition of digital connectivity. The sector produces direct emissions from energy consumption and generation of e-waste. This is despite the possibility that it can reduce indirect emissions through increasing efficiency and behaviour changes such as reduced travel linked to working from home. Studies point out a need for a holistic approach in calculating GHG emissions of the ICT sector, including rebound effects and emissions from the end-of-life. This would ensure indirect emissions and emissions from end-of-life are fully accounted for.

Investment in digital connectivity can support emissions reduction for those primarily industrial sectors that benefit most from efficiency. ICT technology and digitalisation can and does reduce GHG emissions in other industries. Heavy industry and the energy sector would benefit the most from digitalisation. ICT reliant on connectivity is supposed to help meet challenges of emissions reduction although there is a lack of evidence for these claims.

The ICT sector is a source of GHG emissions, which tends to be overlooked. It is our view that the reduction in indirect GHG emissions (largely driven by digitalising and making other sectors more efficient) does not negate the need to reduce the ICT sector’s direct impacts from energy consumption and generation of e-waste.

While the ICT sector focuses on the emissions associated with energy use, which is not insignificant, we have good confidence that the GHG emissions associated with e-waste are of growing concern internationally in terms of reaching climate goals. It is uncertain whether ICT’s GHG emissions reduction potential in other sectors can actually outweigh its direct emissions. It gives us only moderate confidence that the ICT sector can help reduce more emissions than are inherent in the manufacture, use and disposal of the equipment used to achieve those savings.

There is a great deal of speculation that digital technologies have the potential to aid adaptation to climate challenges, especially in rural areas, though with few concrete examples. While there is no direct evidence that investment in digital connectivity supports a just transition, there are many suggestions for mechanisms by which it might influence a just transition. One of these mechanisms is skills development, which is also recognised as a key enabler for net zero. Digital connectivity and ICT are capable of doing both good and bad, either addressing or exacerbating existing inequalities, as well as questions around access to connectivity and skills. Studies repeat the need for strong policy in this area.

- If so, what are the key mechanisms by which this could occur (for example, reduction in travel, investment in green data centres or other mechanisms suggested in the evidence)?

The key mechanisms by which ICT and digitalisation can reduce GHG emissions, as described by literature, include replacing the need to travel, although there is evidence that these savings may not be as high as first thought. The largest source of emissions from ICT equipment is e-waste, which changing standards and upgrading systems can increase. Human behaviour plays a role, either positive or negative, in the emissions from ICT and digitalisation.

- What are key examples of existing policies (in Scotland, such as in local authorities, the UK and/or international examples from comparable countries) designed to support emission reductions, adaptation and/ or just transition through digital connectivity? Is there any evidence for the impact of such policies?

No evidence of impact has been identified during this review. Many of the countries analogous to Scotland have policy that mentioned digitalisation as an enabler or essential piece of their decarbonisation, climate change or net zero agenda. None of them were accompanied by evidence of impact of their policies. This does not prove a lack of progress or attention. There are other countries outside the scope of this research that may have evidence of policy impact.

- What are the different options suggested within the literature for Scotland to provide a baseline assessment of, and monitor carbon emissions from digital infrastructure, technologies, and associated activities?

There are no good examples of what other countries are doing, and this gap is recognised at the European Union level. Standards exist at the corporate or product level, which could be adapted.

- What are the other key gaps in existing knowledge where further research is required to support digital connectivity and Scotland’s climate change goals?

Gaps include a need for a baseline assessment methodology, direct studies exploring the questions asked in this research and a consistent methodology for calculating direct and indirect emissions from ICT and digitalisation.

Gaps identified by this research

We have used specific search criteria and search words and applied them in google and google scholar. On basis of this search, we have found the following evidence gaps:

- There is no active study that has been found within this review that investigates whether investment in digital connectivity directly results in GHG emissions reduction.

There are varying approaches to quantifying direct and indirect emissions of ICT, with no academic or sector wide consensus.

There are different approaches and methodologies for calculating and comparing the GHG emissions of digital and non-digital practices and solutions, for example online versus in-person events. As an example, (Hook, et al., 2020) outlines that working from home evaluations should encompass the following:

- energy footprint

- transportation footprint

- technology footprint

- waste footprint.

The evidence we have found to investigate whether digital connectivity contributes to a just transition and the key mechanisms by which this occurs is not conclusive or good quality.

The ICT sector and literature focus on emissions reduction, with climate adaptation either an afterthought or future looking, with few real-world examples.

Case studies of digital technologies saving money, power or water in municipalities focus on the GHG emissions reduced or averted, with no acknowledgment of rebound effects, which literature states is important.

The GHG emissions associated with the collection and use of data, which is deemed to be necessary to digitalisation, are opaque and limited to specific studies on data centres. For example, the full lifecycle of the Internet of Things is not explored in the literature.

Lack of evidence of policy to address GHG emissions of e-waste e.g. from refrigerants leaking GHG.

Lack of evidence of policy to address the embedded GHG emissions from extraction of raw materials and production of the ICT equipment.

Lack of best practice for measuring, monitoring and assessing the GHG footprint of electronic communications services. The European Commission is also looking to develop this in a Horizon Europe project.

Bibliography

Aebischer & Hilty, 2015. The Energy Demand of ICT: A Historical Perspective and Current Methodological Challenges. In: ICT Innovations for Sustainability. s.l.:s.n., pp. 71-103.

Agency for Digital Government, n.d. Digital Green Transition. [Online]

Available at: https://en.digst.dk/digital-transformation/digital-green-transition/

[Accessed 30 11 2023].

Agency for Digital Government, n.d. Digital Green Transition. [Online]

Available at: https://en.digst.dk/digital-transformation/digital-green-transition/

Blume, A. & Keith, M., 2023. Germany’s green IT initiative is cutting energy consumption and GHG emissions in its public sector. [Online]

Available at: https://blogs.worldbank.org/governance/germanys-green-it-initiative-cutting-energy-consumption-and-ghg-emissions-its-public

[Accessed 30 11 2023].

Building Digital UK, 2023. Building Digital UK – environmental resource guide August 2023. [Online]

Available at: https://www.gov.uk/guidance/building-digital-uk-environmental-resource-guide-august-2023

Centre for Digital Public Services, 2022. Decarbonising Wales with digital technology. [Online]

Available at: https://digitalpublicservices.gov.wales/our-work/decarbonising-wales-digital-technology

Digital.Govt.NZ, 2022. Action Plan for the Digital Strategy for Aotearoa. [Online]

Available at: https://www.digital.govt.nz/digital-government/strategy/digital-strategy-for-aotearoa-and-action-plan/action-plan-for-the-digital-strategy-for-aotearoa/

Digital.Govt.NZ, n.d. The Digital Strategy for Aotearoa. [Online]

Available at: https://www.digital.govt.nz/digital-government/strategy/digital-strategy-for-aotearoa-and-action-plan/the-digital-strategy-for-aotearoa/

Digitalserings Partnerskabet, 2021. Visions and recommendations for Denmark as a digital pioneer. [Online]

Available at: https://en.digst.dk/media/24796/visions-and-recommendations-for-denmark-as-a-digital-pioneer-danish-government-digitisation-partnership.pdf

Dreyfuss, Gadson, Riding & Wang, n.d. The IT Productivity Paradox. [Online]

Available at: https://cs.stanford.edu/people/eroberts/cs201/projects/productivity-paradox/background.html

[Accessed 2023].

Dwivedi, et al., 2022. Climate change and COP26: Are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. International Journal of Information Management, Volume 63.

Kern et al., 2018. Sustainable software products—towards assessment criteria for resource and energy efficiency. Future Generation Computer Systems, Volume 86, pp. 199-210.

Energy Systems Catapult, 2023. Innovating to Net Zero: Digitalisation for Net Zero. [Online]

Available at: https://es.catapult.org.uk/report/innovating-to-net-zero-digitalisation-for-net-zero-emissions/

Ericsson, n.d. ICT and the climate. [Online]

Available at: https://www.ericsson.com/en/reports-and-papers/industrylab/reports/a-quick-guide-to-your-digital-carbon-footprint

Europacable, 2022. Fibre: the most energy-efficient solution to Europe’s bandwidth needs, White Paper. [Online]

Available at: https://europacable.eu/wp-content/uploads/2022/07/Europacable-Whitepaper-on-Energy-Efficiency-of-Fiber-networks-05-July-2022.pdf

European Commission, 2020. Fibre is the most efficient broadband technology. [Online]

Available at: https://digital-strategy.ec.europa.eu/en/library/fibre-most-energy-efficient-broadband-technology

European Commission, 2022. Strategic Foresight Report 2022 Twinning the green and digital transitions in the new geopolitical context. [Online]

Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52022DC0289

European Commission, 2022. Study on Greening Cloud Computing and Electronic Communications Services and Networks: Towards Climate Neutrality by 2050. [Online]

Available at: https://digital-strategy.ec.europa.eu/en/library/study-greening-cloud-computing-and-electronic-communications-services-and-networks-towards-climate

European Commission, 2023. Circular economy: New rules to make phones and tablets more durable, energy efficient and easier to repair, enabling sustainable choices by consumers. [Online]

Available at: https://ec.europa.eu/commission/presscorner/detail/en/ip_23_3315

European Commission, 2023. Report on the state of the Digital Decade 2023. [Online]

Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52023DC0570

European Commission, 2023. Right to repair: Commission introduces new consumer rights for easy and attractive repairs. [Online]

Available at: https://ec.europa.eu/commission/presscorner/detail/en/ip_23_1794

European Commission, n.d. European Digital Rights and Principles. [Online]

Available at: https://digital-strategy.ec.europa.eu/en/policies/digital-principles

European Council, 2020. Digitalisation for the benefit of the environment: Council approves conclusions. [Online]

Available at: https://www.consilium.europa.eu/en/press/press-releases/2020/12/17/digitalisation-for-the-benefit-of-the-environment-council-approves-conclusions/

European Processor Initiative, 2023. Framework partnership agreement in European low-power microprocessor technologies. [Online]

Available at: https://www.european-processor-initiative.eu/

European Union Digital Skills and Jobs Platform, 2023. Estoanian Digital Agenda 2030. [Online]

Available at: https://digital-skills-jobs.europa.eu/en/actions/national-initiatives/national-strategies/estonia-estonian-digital-agenda-2030

European Union Digital Skills and Jobs Platform, 2023. Finland: a snapshot of digital skills. [Online]

Available at: https://digital-skills-jobs.europa.eu/en/latest/briefs/finland-snapshot-digital-skills

Eurostat, n.d. Glossary:Global-warming potential (GWP). [Online]

Available at: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Global-warming_potential_(GWP)

Exponential Roadmap Initiative, 2023. Exponential Climate Roadmap. [Online]

Available at: http://www.exponentialroadmap.org/

Finnish Government, 2022. Government report on the digital compass sets the course for Finland’s digital transformation. [Online]

Available at: https://valtioneuvosto.fi/en/-/10623/government-report-on-the-digital-compass-sets-the-course-for-finland-s-digital-transformation

Freitag, et al., 2021. The real climate and transformative impact of ICT: A critique of estimates, trends, and regulations. Patterns, Volume 3, Issue 8.

Friends of Europe, 2021. Connected Europe: A digital brand for a just transition. [Online]

Available at: https://www.friendsofeurope.org/insights/connected-europe-a-digital-brand-for-a-just-transition/

GeSI and Carbon Trust, 2017. ICT Sector Guidance built on the GHG Protocol Product Life Cycle Accounting and Reporting Standard. [Online]

Available at: https://ghgprotocol.org/sites/default/files/2023-03/GHGP-ICTSG%20-%20ALL%20Chapters.pdf

Global Enabling Sustainability Initiative, 2020. Portugal joins Digital With Purpose to unite sustainability with technology. [Online]

Available at: https://gesi.org/posts/portugal-joins-digital-with-purpose-to-unite-sustainability-with-technology

Government of Canada, 2022. Canada’s Digital Ambition 2022. [Online]

Available at: https://www.canada.ca/en/government/system/digital-government/government-canada-digital-operations-strategic-plans/canada-digital-ambition.html

Government of Iceland, 2021. Policies and Strategies. [Online]

Available at: https://www.government.is/topics/information-technology/policies/

Harvard Business Review, 2022. Is Remote Work Actually Better for the Environment?. [Online]

Available at: https://hbr.org/2022/03/is-remote-work-actually-better-for-the-environment

HCL Tech, 2021. Artificial Intelligence, defined in simple terms. [Online]

Available at: https://www.hcltech.com/blogs/artificial-intelligence-defined-simple-terms

Hischier, R. & Wager, P., 2014. The Transition from Desktop Computers to Tablets: A Model for Increasing Resource Efficiency?. In: ICT Innovations for Sustainability. Advances in Intelligent Systems and Computing. s.l.:s.n.

Hook, A., Court, V., Sovacool, B. K. & Sorrell, S., 2020. A systematic review of the energy and climate impacts of teleworking. Environmental Research Letters, 15(9).

HP Enterprise, n.d. Workload. [Online]

Available at: https://www.hpe.com/us/en/what-is/workload.html

IBM, 2023. What is artificial intelligence (AI)?. [Online]

Available at: https://www.ibm.com/topics/artificial-intelligence

IEA, 2023. Data Centres and Data Transmission Networks. [Online]

Available at: https://www.iea.org/energy-system/buildings/data-centres-and-data-transmission-networks

IEA, n.d. Net Zero Emissions by 2050 Scenario (NZE). [Online]

Available at: https://www.iea.org/reports/global-energy-and-climate-model/net-zero-emissions-by-2050-scenario-nze

IEA, n.d. Tracking Clean Energy Progress 2023. [Online]

Available at: https://www.iea.org/reports/tracking-clean-energy-progress-2023#methodology

[Accessed 08 12 2023].

International Energy Agency, 2023. Data Centres and Data Transmission Networks. [Online]

Available at: https://www.iea.org/energy-system/buildings/data-centres-and-data-transmission-networks

International Telecommunications Union, 2020. ITU-T Recommendations. [Online]

Available at: https://www.itu.int/ITU-T/recommendations/rec.aspx?rec=14084

International Telecommunications Union, 2020. The Global E-waste Monitor 2020. [Online]

Available at: https://www.itu.int/en/ITU-D/Environment/Documents/Toolbox/GEM_2020_def.pdf

Itten, et al., 2020. Digital transformation—life cycle assessment of digital services, multifunctional devices and cloud computing. The International Journal of Life Cycle Assessment, Volume 25, p. 2093–2098.

Lavi, H., 2022. Measuring greenhouse gas emissions in data centres: the environmental impact of cloud computing. [Online]

Available at: https://www.climatiq.io/blog/measure-greenhouse-gas-emissions-carbon-data-centres-cloud-computing

[Accessed 30 11 2023].

Lin, B. & Huang, C., 2023. Nonlinear relationship between digitization and energy efficiency: Evidence from transnational panel data. Energy, Volume 276.

Ministry of Finance Finland, n.d. Sustainable Growth Programme for Finland – boosting reforms and investments. [Online]

Available at: https://vm.fi/en/sustainable-growth-programme-for-finland

National Grid, 2023. How much of the UK’s energy is renewable?. [Online]

Available at: https://www.nationalgrid.com/stories/energy-explained/how-much-uks-energy-renewable#:~:text=20%20April%202023%20saw%20the,achieved%20on%2018%20September%202023.

NGI, 2020. Internet of Waste: The case for a green digital economy. [Online]

Available at: https://media.nesta.org.uk/documents/Internet_of_Waste_-_The_case_for_a_green_digital_economy_1.pdf

Nordic Council of Ministers, n.d. Report: A study of the digital green transition in the Nordic Baltic countries. [Online]

Available at: https://en.digst.dk/media/27140/bilag-3a-study-of-the-digital-green-transition-in-the-nordic-baltic-countries.pdf

Norway and European Union, n.d. Norway EU Green Alliance. [Online]

Available at: https://www.regjeringen.no/contentassets/debc1b0c0a2f47d1b77beb96d896cf45/20230420eu-norway-green-alliance-final.pdf

Norway Grants, n.d. Estonia – Green ICT. [Online]

Available at: https://eea.innovationnorway.com/article/estonia-green-ict

Norwegian Minstry of Foreign Affairs, n.d. Digitalisation for Development: Digital strategy for Norwegian development policy. [Online]

Available at: https://www.regjeringen.no/globalassets/departementene/ud/dokumenter/utvpolitikk/digital_strategynew.pdf

OECD Library, 2023. Information and communication technology (ICT). [Online]

Available at: https://www.oecd-ilibrary.org/science-and-technology/information-and-communication-technology-ict/indicator-group/english_04df17c2-en

OECD, 2018. OECD Reviews of Digital Transformation. [Online]

Available at: https://www.oecd.org/sweden/going-digital-in-sweden.pdf

Ontario, 2020. Ontario Onwards. [Online]

Available at: https://files.ontario.ca/tbs-ontario-onwards-action-plan-en-2020-10-18.pdf

Ontario, n.d. Building a Digital Ontario. [Online]

Available at: https://www.ontario.ca/page/building-digital-ontario#section-0

Osoro, O., Oughton, E., Wilson, A. & Rao, A., 2023. Sustainability assessment of Low Earth Orbit (LEO) satellite broadband mega-constellations. [Online]

Available at: https://arxiv.org/abs/2309.02338

Portugal Digital, 2020. Action Plan for the Digital Transition: Strategy for the digital transition in Portugal. [Online]

Available at: https://portugaldigital.gov.pt/plano-de-acao-para-a-transicao-digital/